abnormal gain

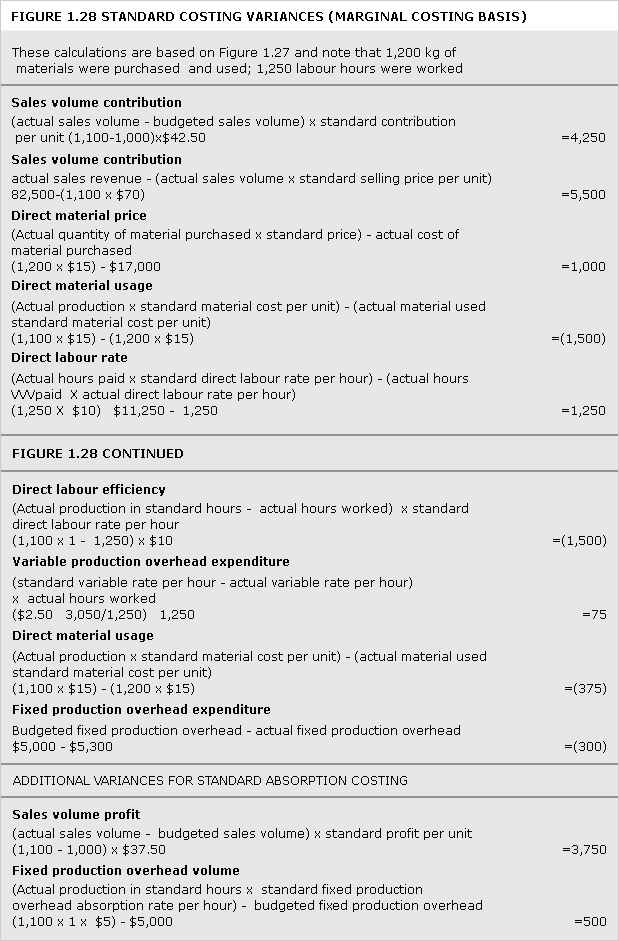

Improvement on the accepted or normal level of loss associated with a production activity. It is isolated as a period entry rather than as an adjustment to product cost.

abnormal loss

Any loss in excess of the normal loss allowance. It is isolated as a period entry rather than as a component of product cost.

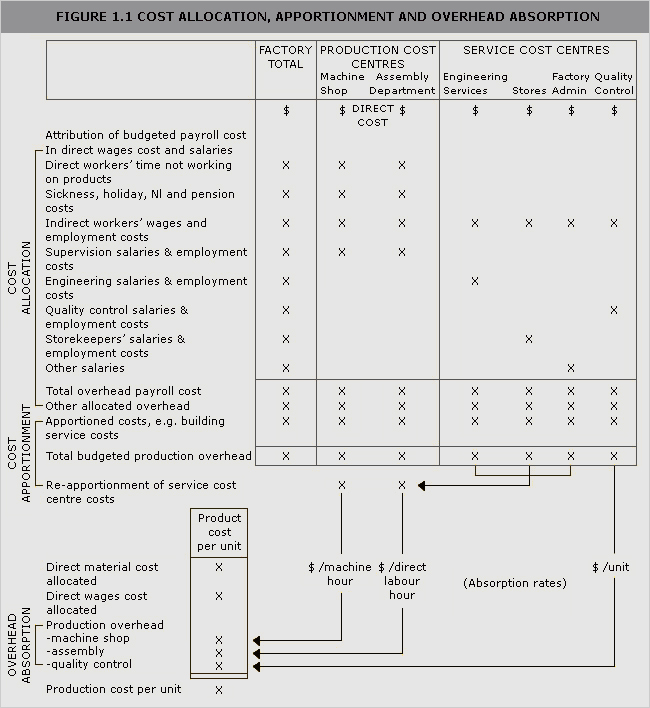

absorbed overhead

Overhead attached to products or services by means of an absorption rate, or rates.

under- or over-absorbed overhead: The difference between overhead incurred and overhead absorbed, using an estimated rate, in a given period.

If overhead absorbed is less than that incurred there is under-absorption; if overhead absorbed is more than that incurred there is over-absorption. Over- and under-absorptions are treated as period cost adjustments.

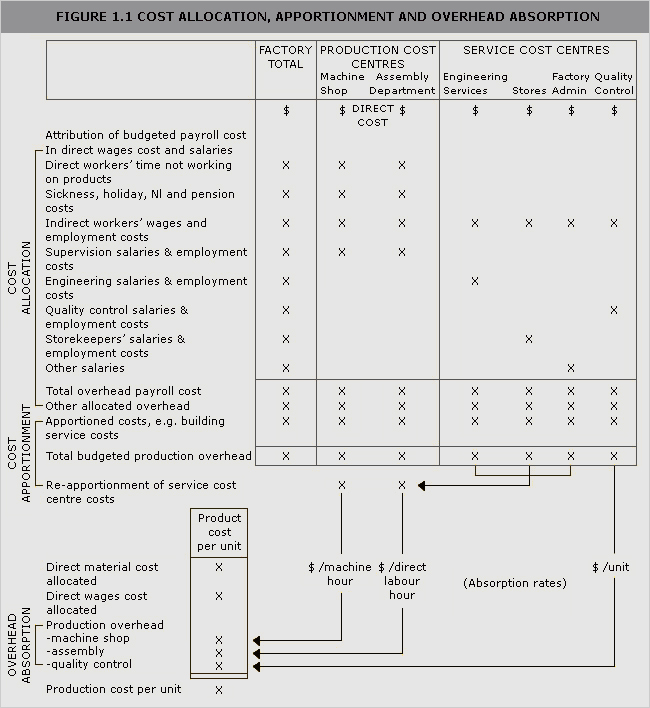

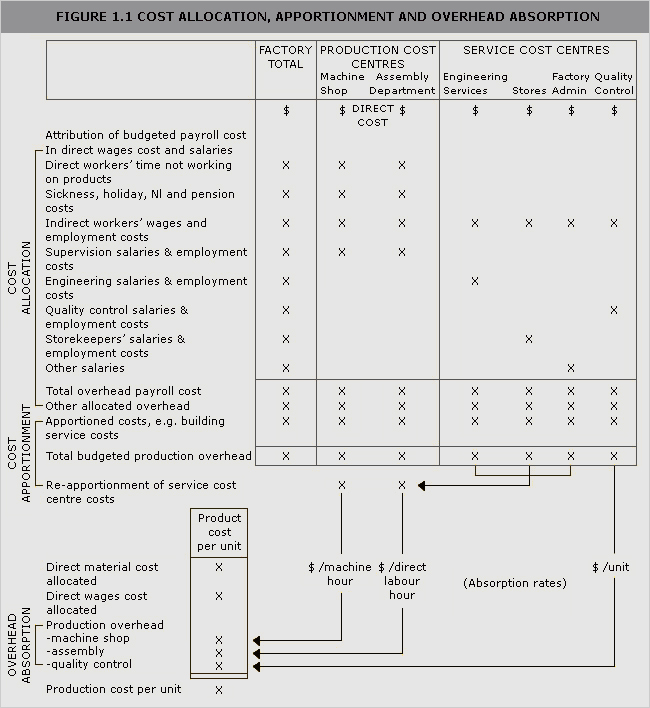

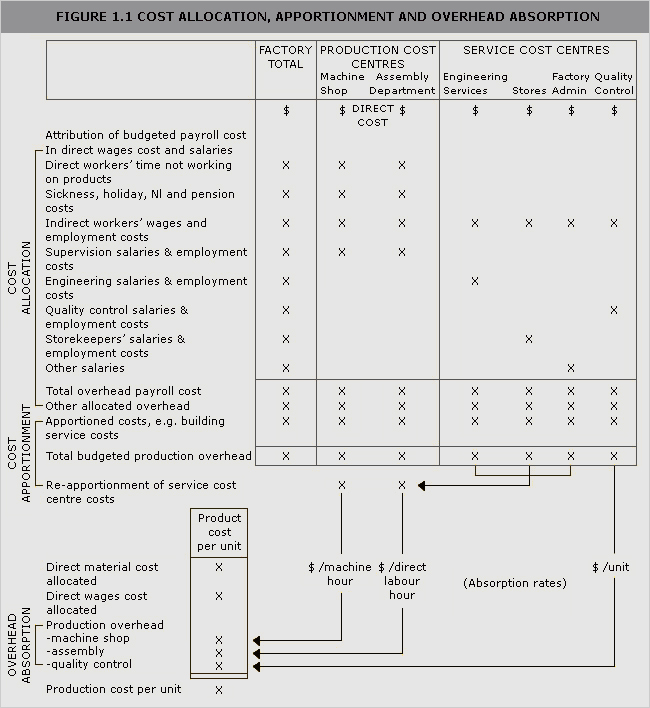

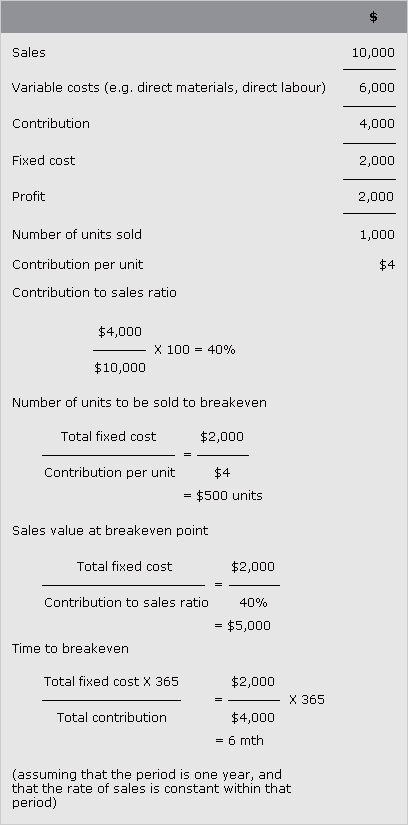

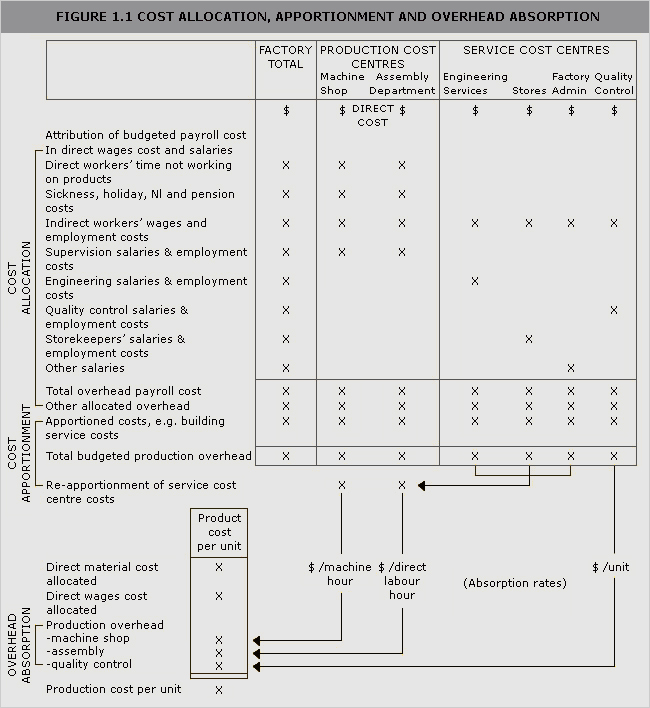

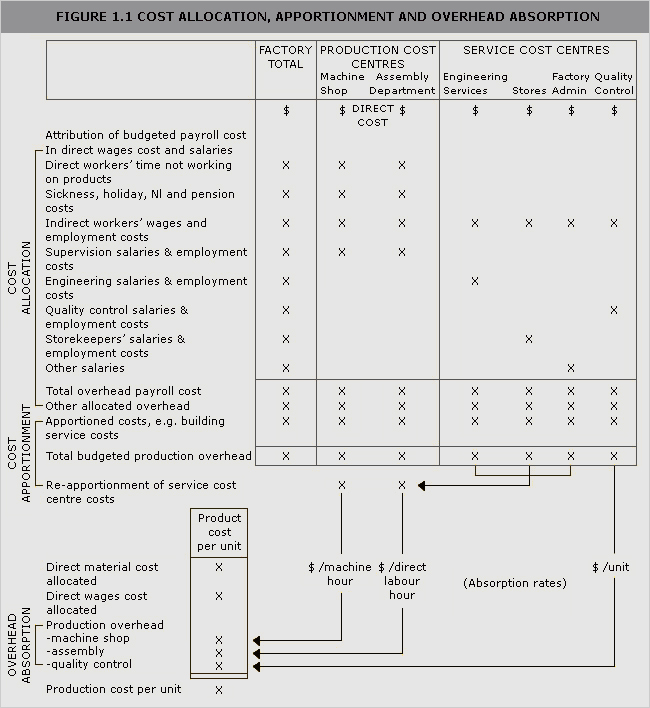

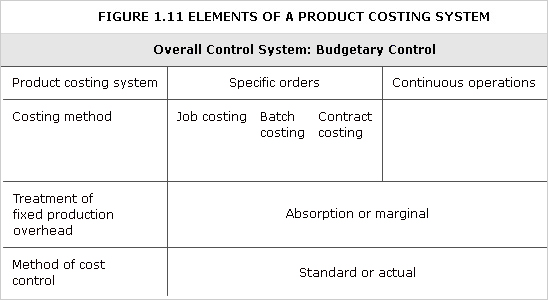

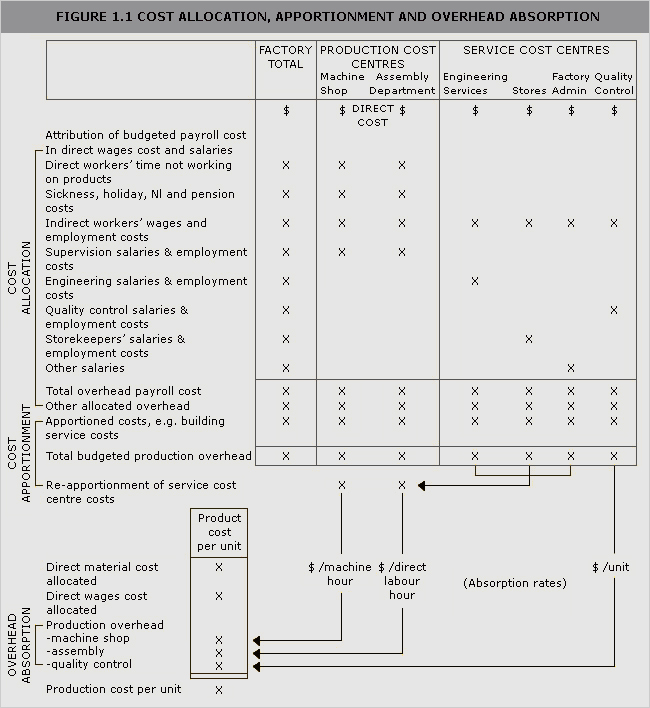

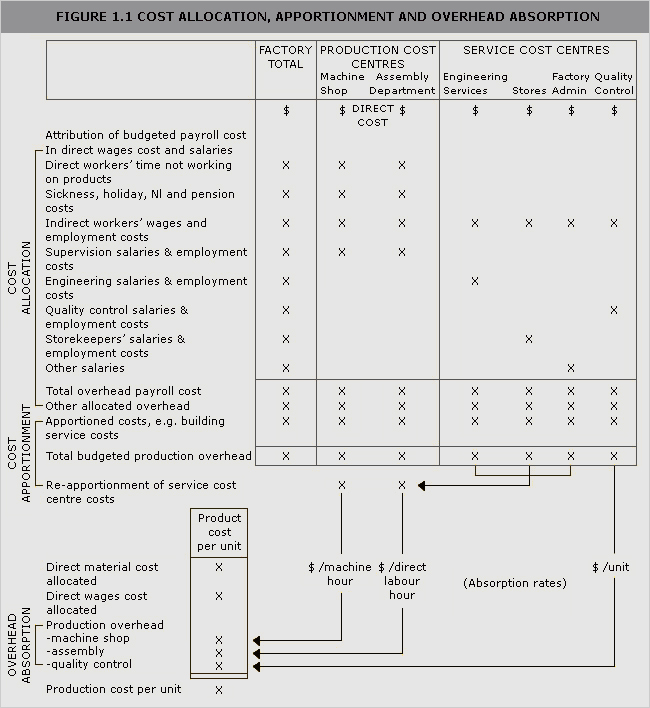

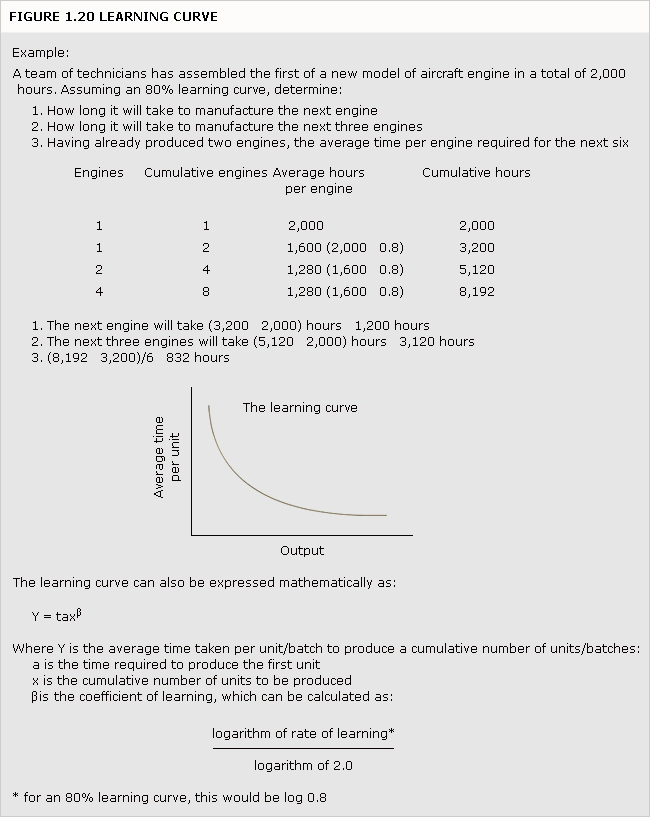

See Figure 1.1.

absorption rate

See overhead absorption rate.

account

Structured record of transactions in monetary terms kept as part of an accounting system. This may be a simple list, or entries on a debit and credit basis, maintained either manually or as a computer record.

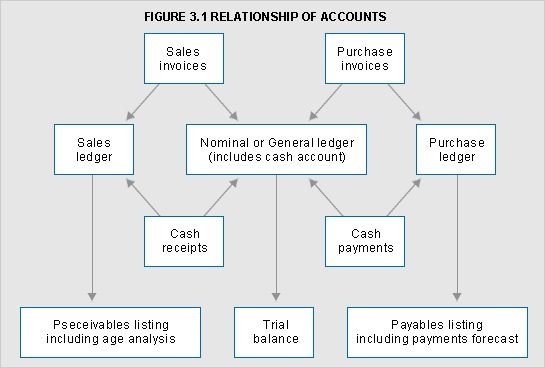

See Figure 3.1 for an illustration of the relationship of accounts.

cash account: Record of receipts and payments of cash, cheques or other forms of money transfer.

nominal account: Record of revenues and expenditures, liabilities and assets classified by their nature, for example sales, rent, rates, electricity, wages and share capital. These are sometimes referred to as impersonal accounts.

personal account: Record of amounts receivable from or payable to a person or an entity. A collection of these accounts is known as a sales/debtor ledger, or a purchases/creditors ledger. In the US the terms receivables ledger and payables ledger are used and are consistent with IAS 1.

accounting manual

Collection of accounting instructions governing the responsibilities of persons, and the procedures, forms and records relating to the preparation and use of accounting data. There can be separate manuals for the constituent parts of the accounting system, such as a budget manual or cost accounting manual.

accounting period

Time period covered by the accounting statements of an entity. There may be different time periods for different accounting statements, for example, management accounts may be for four- or five-week periods to coincide with a thirteen-week financial accounting period.

accounting policies

Specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting its financial statements (IAS 8)

accounting reference period

Period for which an entity prepares its financial statements. This period is normally, though not necessarily, twelve months. Also used for taxation where it represents the period upon which adjusted profits, for corporation/income tax purposes, is based.

accounting standards

See International Financial Reporting Standards (IFRSs), which includes International Accounting Standards (IASs). In the UK there are Statements of Standard Accounting Practice (SSAPs) and Financial Reporting Standards (FRSs). All International and UK Accounting Standards are listed in Appendices 1 and 2.

Accounting Standards Board (ASB)

UK standard-setting body established to develop, issue and withdraw accounting standards. Its aims are to establish and improve standards of financial accounting and reporting, for the benefit of users, preparers and auditors of financial information (ASB). It will work with and influence the International Accounting Standards Board (IASB) in addressing UK accounting issues.

accounts, integrated

Set of accounting records that integrates both financial and cost accounts using a common input of data for all accounting purposes.

accounts, interlocking

Set of accounting records where the cost and financial accounts are distinct, the two being kept continuously in agreement by the use of control accounts or reconciled by other means.

accruals basis of accounting

Effects of transactions and other events are recognised in financial statements when they occur and not when cash and cash equivalents are received or paid (IASB Framework).

acquisition date

Date on which the acquirer effectively obtains control of the acquiree (IFRS 3).

activities, hierarchy of

Classification of activities by level of organisation, for example unit, batch, product sustaining and facility sustaining.

activity, batch level

Activity (such as setting up machines) where volume varies directly with the number of batches of output but is independent of the number of units in a batch.

See activities, hierarchy of.

activity cost pool

Aggregation of all costs related to a specific activity.

activity driver

Transaction that causes an activity. For example, receipt of a sales order sets in train the order processing activity.

activity driver analysis

Identification and evaluation of the activity drivers used to trace the cost of activities to cost objects.

activity, facility sustaining

Activity undertaken to support the organisation as a whole, and which cannot be logically linked to individual units of output. Accounting is a facility sustaining activity.

See activities, hierarchy of.

activity, product sustaining

Activity undertaken to develop or sustain a product (or service). Product sustaining costs are linked to the number of products or services, not to the number of units produced.

activity-based budgeting

Method of budgeting based on an activity framework and utilising cost driver data in the budget setting and variance feedback processes.

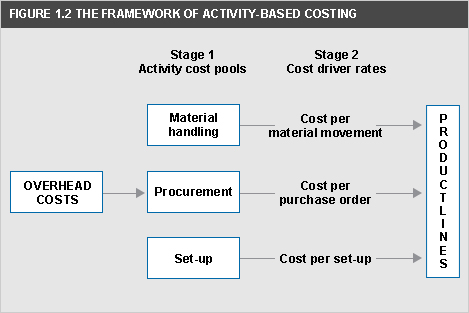

activity-based costing (ABC)

Approach to the costing and monitoring of activities which involves tracing resource consumption and costing final outputs. Resources are assigned to activities, and activities to cost objects based on consumption estimates. The latter utilise cost drivers to attach activity costs to outputs.

See Figure 1.2.

activity-based costing, time-driven (time-driven ABC)

Approach to ABC based on the time required for each unit activity. The method avoids the use of interviews with operating managers in order to estimate percentage of time spent on different areas of work. It is claimed that 'time-driven ABC' based on 'time per transactional activity' is simpler to install and update and can highlight unused capacity.

activity-based management (ABM)

operational ABM: Actions, based on activity driver analysis, that increase efficiency, lower costs and/or improve asset utilisation.

strategic ABM: Actions, based on activity-based cost analysis, that aim to change the demand for activities so as to improve profitability.

actuarial assumptions

An entity's unbiased best estimates of the demographic and financial variables that will determine the ultimate cost of providing post employment benefits (IAS 19).

adjusted present value (APV)

Net present value of an asset that also takes account of any financing side effects.

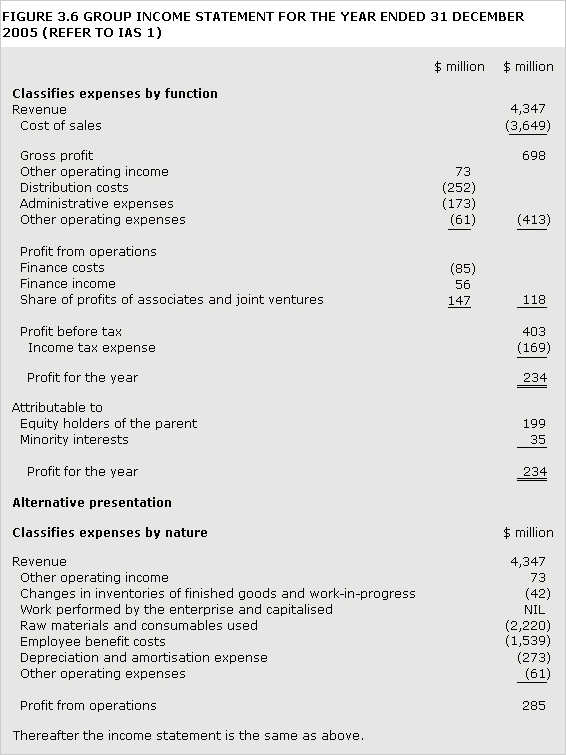

administrative expenses

Cost of management, secretarial, accounting and other services which cannot be related to the separate production, marketing or research and development functions. These expenses are reported in the income statement.

ad valorem (duty)

Duty based on the value of a product or service.

allocate

To assign a whole item of cost, or of revenue, to a single cost unit, centre, account or time period. In the US, 'allocate' does not have this precise meaning, it is used more generally to refer to the whole process of overhead apportionment, allocation and absorption.

See Figure 1.1.

Alternative Investment Market (AIM)

Securities market designed primarily for small companies, regulated by the UK stock exchange but with less demanding rules than apply to the stock exchange official list of companies.

amortisation

Systematic allocation of the depreciable amount of an asset over its useful life (IAS 36). Normally applied to intangible assets and goodwill.

amortised cost (for a financial asset or liability)

Amount at which the financial asset or liability is measured, at initial recognition minus principal repayments, plus or minus cumulative amortisation using the effective interest in the item (refer to IAS 39).

analytical review

An audit technique used to help analyse data to identify trends, errors, fraud, inefficiency and inconsistency. Its purpose is to understand what has happened in a system, to compare this with a standard and to identify weaknesses in practice or unusual situations that may require further investigation. The main methods of analytical review are ratio analysis, non-financial performance analysis, internal and external benchmarking and trend analysis. While the purpose of analytical review in external audit is to understand financial performance and position and to identify areas for more in-depth audit treatment, analytical review in internal audit aims to better understand the control environment and identify potential control weaknesses.

annual equivalent rate (AER)

Notional annual rate which is equivalent to another set of rates that may be paid other than annually.

annual report and accounts

Package of information including a management report, an auditor's report and a set of financial statements with supportive notes. In the case of companies these are drawn up for a period which is called the accounting reference period, the last day of which is known as the reporting date.

annuity

Fixed periodic payment which continues either for a specified time, or until the occurrence of a specified event.

See perpetuity.

anti-dilution

Increase in earnings per share, or a reduction in loss per share, resulting from the assumption that convertible instruments are converted or options or warrants are exercised (refer to IAS 33).

Also see dilution.

apportion

To spread indirect revenues or costs over two or more cost units, centres, accounts or time periods. This may also be referred to as 'indirect allocation'.

re-apportion: The re-spread of costs apportioned to service departments to production departments.

See Figure 1.1

apportionment basis

Physical or financial unit used to apportion costs to cost centres.

appropriation account

Record of how the surplus/deficit of a period has been allocated to distributions to owners and retentions by the entity.

arbitrage

Simultaneous purchase and sale of a security in different markets with the aim of making a risk-free profit through the exploitation of any price difference between the markets.

arrangement fees

See issue costs.

articles of association

Document which, with the memorandum of association, provides the legal constitution of a company. The articles of association define the rules and regulations governing the management of the affairs of the company, the rights of the members (shareholders), and the duties and powers of the directors.

See memorandum of association.

asset

Resource controlled by the entity as a result of past events and from which future economic benefits are expected to flow to the entity (IAS 38).

associate

An entity, including an unincorporated entity such as a partnership, over which the investor has significant influence and that is neither a subsidiary nor an interest in a joint venture (refer to IAS 28).

audit

Systematic examination of the activities and status of an entity, based primarily on investigation and analysis of its systems, controls and records.

audit, compliance

Audit of specific activities in order to determine whether performance is in conformity with a predetermined contractual, regulatory or statutory requirement.

audit, cost

Verification of cost records and accounts, and a check on adherence to prescribed cost accounting procedures and their continuing relevance.

audit, environmental

Systematic, documented, periodic and objective evaluation of how well an entity, its management and equipment are performing with the aim of helping to safeguard the environment by facilitating management control of environmental practices and assessing compliance with entity policies and external regulations.

audit, internal

Independent appraisal function established within an organisation to examine and evaluate its activities as a service to the organisation. The objective of internal auditing is to assist members of the organisation in the effective discharge of their responsibilities. To this end, internal auditing furnishes them with analyses, appraisals, recommendations, counsel and information concerning the activities reviewed (Institute of Internal Auditors—UK).

audit, management

Objective and independent appraisal of the effectiveness of managers and the corporate structure in the achievement of entity objectives and policies. Its aim is to identify existing and potential management weaknesses and to recommend ways to rectify them.

audit, post-completion

Objective, independent assessment of the success of a capital project in relation to plan. Covers the whole life of the project and provides feedback to managers to aid the implementation and control of future projects.

audit report

Formal document in which an auditor expresses an opinion as to whether the financial statements of an entity show a true and fair view of its position at a given date and the results of its operations for the accounting period ended on that date have been properly prepared in accordance with the relevant statutory requirements, accounting standards, or any report by an auditor in accordance with the terms of appointment.

audit, statutory external

Periodic examination of the books of accounts and records of an entity carried out by an independent third party (the auditor) to ensure that they have been properly maintained, are accurate and comply with established concepts, principles, accounting standards, legal requirements and give a true and fair view of the financial state of the entity.

audit trail

Linked chain of evidence which connects accounting information with the source document which verifies its validity.

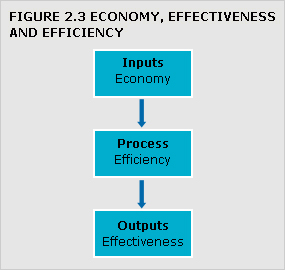

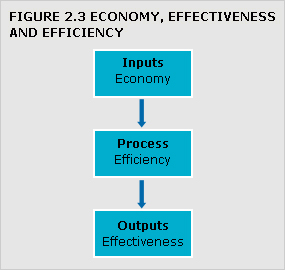

audit, value for money

Investigation into whether proper arrangements have been made for securing economy, efficiency and effectiveness in the use of resources.

Auditing Practices Board (APB)

A body formed by an agreement between the six members of the Consultative Committee of Accountancy Bodies (CCAB), to be responsible for developing and issuing professional standards for auditors in the UK and the Republic of Ireland. From 2005, the APB will no longer issue its own standards but require the adoption of International Standards of Auditing (ISAs) issued by the International Auditing and Assurance Standards Board (IAASB).

See Consultative Committee of Accountancy Bodies.

available-for-sale financial assets

Non-derivative financial asset that is designated as being available for sale and not classified as loans and receivables, held-to-maturity investments, or financial assets held at fair value (IAS 39).

back-to-back loan

Form of financing whereby money borrowed in one country, or currency is covered by lending an equivalent amount in another.

BACS

Formerly the Bankers Automated Clearing Services. UK electronic bulk clearing system generally used by banks and building societies for low-value and/or repetitive items such as standing orders, direct debits and automated credits such as salary payments.

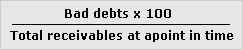

bad debt

Debt or trade receivable which is, or is considered to be, uncollectable and is, therefore, written off either as a charge to the income statement or against an existing doubtful debt provision.

See doubtful debts provision.

balance (on an account)

Difference between the totals of the debit and credit entries in an account.

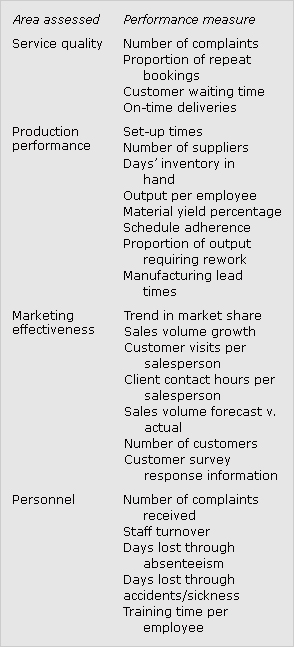

balanced scorecard approach

Approach to the provision of information to the management to assist strategic policy formulation and achievement. It emphasises the need to provide the user with a set of information which addresses all relevant areas of performance in an objective and unbiased fashion. The information provided may include both financial and non-financial elements, and cover areas such as profitability, customer satisfaction, internal efficiency and innovation.

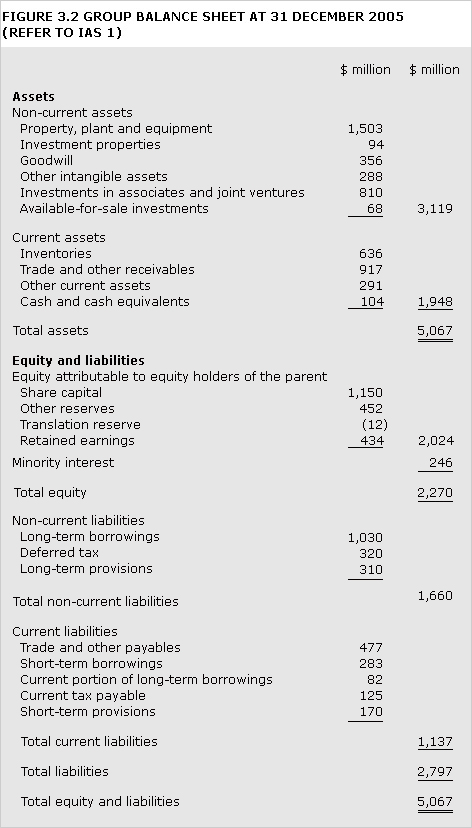

balance sheet

Statement of the financial position of an entity at a given date disclosing the assets, liabilities and equity (such as shareholders' contributions and reserves) prepared to give a true and fair view of the entity at that date.

See Figure 3.2.

balancing allowance/charge

Relief for tax purposes of capital expenditure, or the claw back of relief already given, administered in the year in which a real asset is disposed of or an entity ceases to exist.

bank charge

Amount charged by a bank to its customers for services provided, for example for servicing customer accounts or arranging foreign currency transactions or letters of credit, but excluding interest.

bank overdraft

Borrowings from a bank on current account, normally repayable on demand. The maximum permissible overdraft is normally agreed with the bank prior to the facility being made available, and interest, calculated on a daily basis, is charged on the amount borrowed, and not on the agreed maximum borrowing facility.

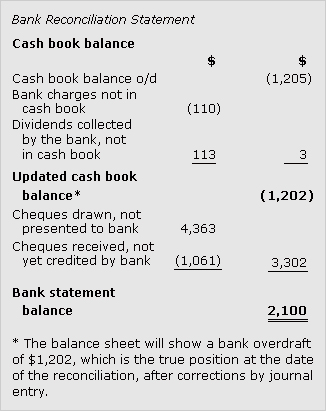

bank reconciliation

Detailed statement reconciling, at a given date, the cash balance in an entity's cash book with that reported in a bank statement. An example is given below:

bankruptcy

Legal status of an individual against whom an adjudication order has been made by the court primarily because of inability to meet financial liabilities.

barrier to entry

Any impediment to the free entry of new competitors into a market.

barrier to exit

Any impediment to the exit of existing competitors from a market.

batch

Group of similar units which maintains its identity throughout one or more stages of production and is treated as a cost unit.

behavioural implications, accounting

Ways in which people affect, and are affected by, the creation, existence and use of accounting information. For example,

See budgeting, behavioural aspects and consequences.

bear market

Securities market experiencing a prolonged widespread decline in prices.

See bull market.

bearer bond

Negotiable bond (or security) whose ownership is not registered by the issuer, but is presumed to lie with whoever has physical possession of the bond.

benchmarking

Establishment, through data gathering, of targets and comparators that permit relative levels of performance (and particularly areas of underperformance) to be identified. Adoption of identified best practices should improve performance.

internal benchmarking: Comparing one operating unit or function with another within the same industry.

functional benchmarking: Comparing internal functions with those of the best external practitioners, regardless of their industry (also known as operational benchmarking or generic benchmarking).

competitive benchmarking: In which information is gathered about direct competitors through techniques such as reverse engineering.

strategic benchmarking: Type of competitive benchmarking aimed at strategic action and organisational change.

beta factor

Measure of systematic risk of a security relative to the market portfolio. If a security were to rise or fall at double the market rate, it would have a beta factor of 2.0. Conversely, if the security price moved at half the market rate, the beta factor would be 0.5.

See risk, market/systematic.

bid-ask spread

Difference between the buying and selling prices of a traded commodity or a financial instrument. Also known as bid-offer spread.

bill of lading

Document prepared by a consignor by which a carrier acknowledges the receipt of goods and which serves as a document of title to the goods consigned.

bill of materials

Detailed specification, for each product, of the subassemblies, components and materials required, distinguishing items purchased externally from those manufactured in-house.

bill payable

Bill of exchange or promissory note payable.

bill receivable

Bill of exchange or promissory note receivable.

Black-Scholes method (share options)

Equation developed by F. Black and M. Scholes to value a European-style call option that uses the share price, the exercise price, the risk-free interest rate, the time to maturity and the standard deviation of the share return. A European option can be exercised only on the expiration date.

See European-style option (option).

blue chip

Description of an equity or company which is of the highest quality, and in which an investment would be regarded as low risk with regard to both dividend payments and capital values.

bond

Debt instrument, normally offering a fixed rate of interest (coupon) over a fixed period of time, and with a fixed redemption value (par).

bonus/scrip issue

Capitalisation of the reserves of an entity by the issue of additional shares to existing shareholders in proportion to their holdings. Such shares are normally fully paid-up with no cash called for from the shareholders.

See rights issue.

bookkeeping

Recording of monetary transactions, appropriately classified, in the financial records of an entity.

See double entry bookkeeping.

borrowing costs

Interest and other costs incurred by an entity in connection with the borrowing of funds. They may include:

(a) interest on bank overdrafts and borrowings;

(b) amortisation of discounts or premiums related to borrowings;

(c) amortisation of ancillary costs incurred in connection with the arrangement of borrowings;

(d) finance charges in respect to finance leases; and

(e) exchange differences arising from foreign currency borrowings to the extent they are regarded as an adjustment to interest costs (IAS 23).

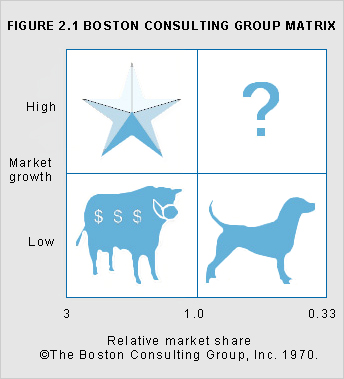

Boston Consulting Group matrix

A representation of an entity's product or service offerings which shows the value of each product's sales expressed in relation to the growth rate of the market served and the market share held. The objective of the matrix is to assist in the allocation of funds to products. Products can be classified as star, cash cow, problem child or dog, according to their position on the matrix.

See Figure 2.1.

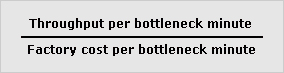

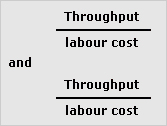

bottleneck

Facility that has lower capacity than prior or subsequent facilities and restricts output based on current capacity.

See theory of constraints, throughput.

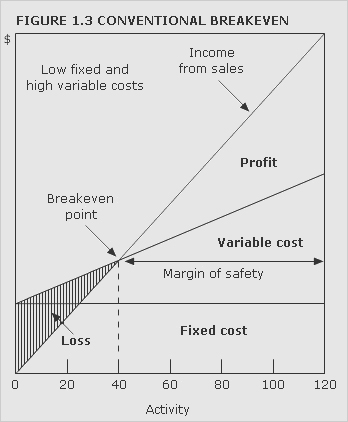

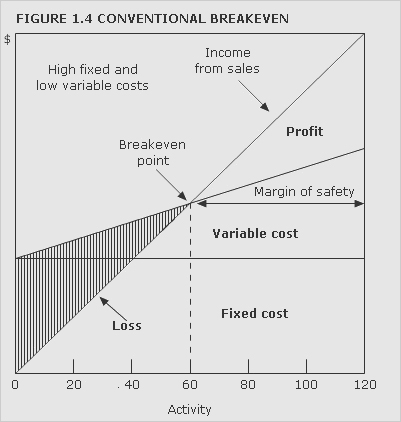

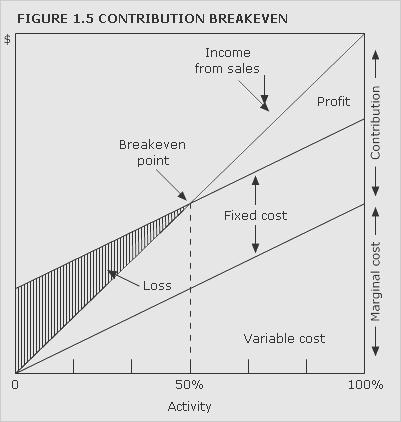

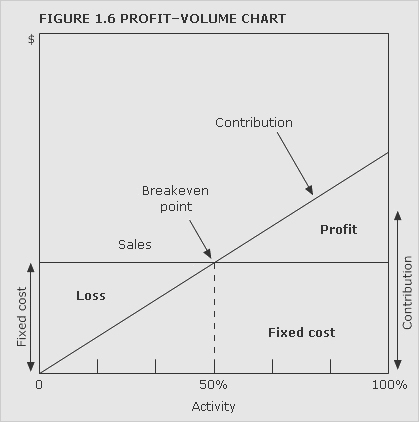

breakeven chart

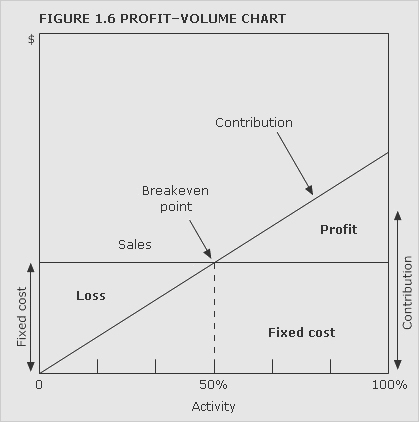

Chart that indicates approximate profit or loss at different levels of sales volume within a limited range. For examples of conventional breakeven charts under different cost structures,

See Figures 1.3 and 1.4. Figure 1.5 shows a contribution breakeven chart and Figure 1.6 a profit-volume chart.

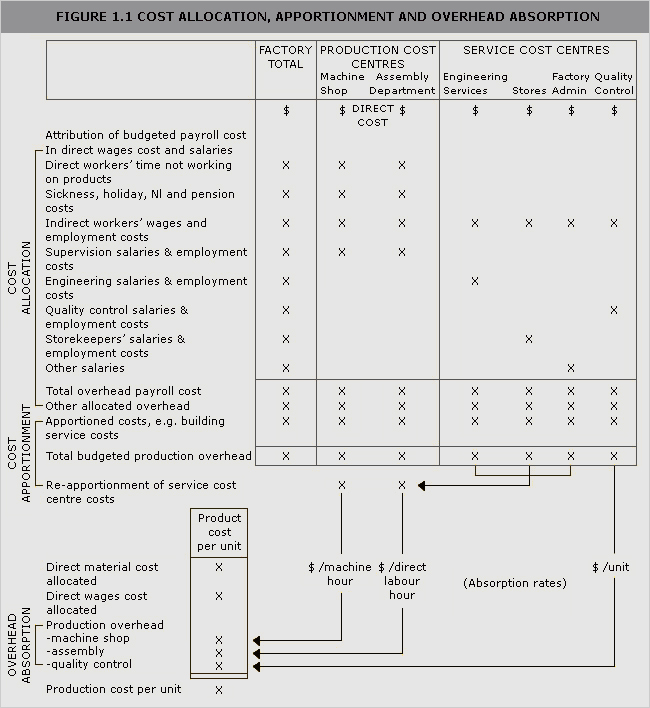

breakeven point

Level of activity at which there is neither profit nor loss. It can be ascertained by using a breakeven chart or by calculation.

See Figures 1.3, 1.4, 1.5, 1.6 and example:

budget

Quantitative expression of a plan for a defined period of time. It may include planned sales volumes and revenues; resource quantities, costs and expenses; assets, liabilities and cash flows.

budget, cash

Detailed budget of estimated cash inflows and outflows incorporating both revenue and capital items.

budget centre

Section of an entity for which control may be exercised through prepared budgets. It is often a responsibility centre where the manager has authority over, and responsibility for, defined costs and (possibly) revenues.

budget cost allowance

Calculated after an accounting period, the cost allowance reflects the actual level of output achieved. Variable costs are flexed in proportion to volume achieved and fixed costs are based on the annual budget.

budget, departmental/functional

Budget of income and/or expenditure applicable to a particular function frequently including sales budget, production cost budget (based on budget production, efficiency and utilisation), purchasing budget, human resources budget, marketing budget, and research and development budget.

budget, fixed

Budget set prior to the control period and not subsequently changed in response to changes in activity, costs or revenues. It may serve as a benchmark in performance evaluation.

budget, flexible

See budget flexing.

budget flexing

Flexing variable costs from original budgeted levels to the allowances permitted for actual volume achieved while maintaining fixed costs at original budget levels. (Variable cost allowance = Ratio of actual volume achieved to budget volume x original budget variable cost)

budget lapsing

Withdrawal of unspent budget allowance due to the expiry of the budget period.

budget, line item

Traditional form of budget layout showing, line by line, the costs of a cost centre analysed by their nature (for example salaries, occupancy, maintenance).

budget manual

Detailed set of guidelines and information about the budget process typically including a calendar of budgetary events, specimen budget forms, a statement of budgetary objectives and desired results, listing of budgetary activities and budget assumptions regarding, for example, inflation and interest rates.

budget, master

Consolidates all subsidiary budgets and is normally comprised of the budgeted profit and loss account, balance sheet and cash flow statement.

budget, operating

Budget of the revenues and expenses expected in a forthcoming accounting period.

budget padding

See budget slack

budget period

Period for which a budget is prepared and used, which may then be subdivided into control periods.

budget, principal factor

Principal budget factor limits the activities of an undertaking. Identification of the principal budget factor is often the starting point in the budget setting process. Often the principal budget factor will be sales demand but it could be production capacity or material supply.

budget purposes

Budgets may help in authorising expenditure, communicating objectives and plans, controlling operations, co-ordinating activities, evaluating performance, planning and rewarding performance. Often, reward systems involve comparison of actual with budgeted performance.

budget, rolling/continuous

Budget continuously updated by adding a further accounting period (month or quarter) when the earliest accounting period has expired. Its use is particularly beneficial where future costs and/or activities cannot be forecast accurately.

See rolling forecast.

budget setting processes

bottom-up budgeting: Budgeting process where all budget holders have the opportunity to participate in setting their own budgets.

imposed/top-down budgeting: Budgeting process where budget allowances are set without permitting ultimate budget holders the opportunity to participate in the process.

negotiated budget: Budget in which budget allowances are set largely on the basis of negotiations between budget holders and those to whom they report.

participative budgeting:

See bottom-up budgeting.

budget slack

Intentional overestimation of expenses and/or underestimation of revenue during budget setting. Also known as budget padding.

budget virement

Authority to apply saving under one budget subhead to meet excesses on others.

budgetary control

Master budget, devolved to responsibility centres, allows continuous monitoring of actual results versus budget, either to secure by individual action the budget objectives or to provide a basis for budget revision.

See control, feedback and control, feedforward.

budgeting, behavioural aspects and consequences

budget constrained style: Excessive pressure to achieve budgets that can lead to job-related tension, recriminations, buck—passing and budget padding.

non-accounting style: Management style that largely ignores budgets and financial information.

profit conscious style: Management style that takes account of budgets together with other information and evaluates managerial performance in a flexible manner.

target setting: 'Tight but achievable' levels are recommended to motivate optimum performance. Too loose a budget can lead to under-achievement as can too tight a budget—and this can also be de-motivating.

budgeting, beyond

Idea that companies need to move beyond budgeting because of the inherent flaws in budgeting especially when used to set incentive contracts. It is argued that a range of techniques, such as rolling forecasts and market-related targets, can take the place of traditional budgets.

budgeting, incremental

Method of budgeting based on the previous budget or actual results, adjusting for known changes and inflation, for example.

budgeting, priority-based

Method of budgeting whereby budget requests are accompanied by a statement outlining the changes expected if the prior period budget were increased or decreased by a certain amount or percentage. These changes are prioritised.

budgeting, zero-based

Method of budgeting that requires all costs to be specifically justified by the benefits expected.

bull market

Securities market experiencing prolonged widespread price increases.

See bear market.

burden

US equivalent of 'overhead'.

business angels

Wealthy individuals prepared to invest in a start-up, early stage or developing firm. Often, they have managerial and/or technical experience to offer to the management team as well as debt and equity finance.

business combination

Bringing together of separate entities or businesses into one reporting entity (IFRS 3). In all business combinations, one entity (the acquirer) will obtain control of another entity (the acquiree) and an acquirer should be identified for all such combinations. (This means all business combinations involving an acquirer and an acquiree should be accounted for by applying the purchase (acquisition) method. The 'uniting of interests' (merger) method is now abolished.) Refer to IFRS 3.

business process re-engineering

Selection of areas of business activity in which repeatable and repeated sets of activities are undertaken, and the development of improved understanding of how they operate and of the scope for radical redesign with a view to creating and delivering better customer value.

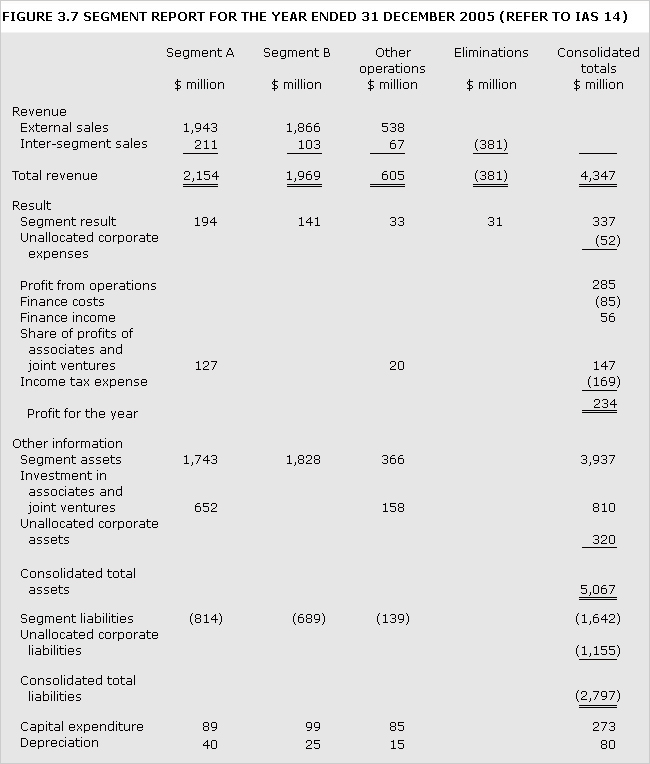

business segment

Distinguishable component of an entity that is engaged in providing an individual product or service (or group of products or services) and that is subject to risks and returns that are different from those of other segments (IAS 14).

See geographic segment.

by-product

Output of some value produced incidentally while manufacturing the main product.

See joint products.

call

Request made to the holders of partly paid-up share capital for the payment of a predetermined sum due on the share capital, under the terms of the original subscription agreement. Failure on the part of the shareholder to pay a call may result in the forfeiture of the relevant holding of partly paid shares.

call off

System whereby stock is held at the customer's premises, to be invoiced only on use.

call option

Option to buy a specified underlying asset at a specified exercise price on, or before, a specified exercise date.

See exercise price, option, put option.

capital allowance

Relief from income tax or corporation tax on capital expenditure on eligible assets.

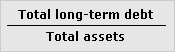

capital asset pricing model (CAPM)

Theory which predicts that the expected risk premium for an individual stock will be proportional to its beta, such that: (Expected risk premium on a stock = beta x expected risk premium in the market.) Risk premium is defined as the expected incremental return for making a risky investment rather than a safe one.

capital budgeting

Process concerned with decision-making in respect of the choice of specific investment projects and the total amount of capital expenditure to commit.

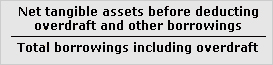

capital employed

Investment in an entity. In assessing managers it is usually calculated as total assets less current liabilities.

equity capital employed: Shareholders' stake in the company. This is important when calculating return to shareholders.

capital expenditure

Costs incurred in acquiring, producing or enhancing non-current assets (both tangible and intangible).

See revenue expenditure.

capital expenditure control

Procedures for authorising and subsequently monitoring capital expenditure.

capital expenditure proposal/authorisation

Formal request for authority to incur capital expenditure usually supported by the case for expenditure in accordance with capital investment appraisal criteria. Levels of authority should be clearly defined with reporting of actual expenditure to the equivalent authority levels.

capital gain/loss

Extent by which the net realised value of a capital asset exceeds (or in the case of a capital loss is less than) the cost of acquisition plus additional improvements, less depreciation charges where applicable. It can also arise from the exchange of such an asset for another of a different type. The term can have other interpretations for tax purposes.

capital instrument

All instruments that are issued by reporting entities as a means of raising finance, including shares, debentures, loans and debt instruments, options and warrants that give the holder the right to subscribe for or obtain capital instruments. In the case of consolidated financial statements the term includes capital instruments issued by subsidiaries except those that are held by another member of the group included in the consolidation (FRS 4).

capital investment appraisal

Application of a set of methodologies (generally based on the discounting of projected cash flows) whose purpose is to give guidance to managers with respect to decisions as to how best to commit long-term investment funds.

See discounted cash flow.

capital maintenance

Principle that profit is only recorded after capital has been maintained intact. There are two bases on which capital can be defined, financial and physical.

capital rationing

Restriction on an entity's ability to invest capital funds, caused by an internal budget ceiling being imposed on such expenditure by management (soft capital rationing), or by external limitations being applied to the company, as when additional borrowed funds cannot be obtained (hard capital rationing).

capital redemption reserve

Account required to prevent a reduction in capital, where an entity purchases or redeems its own shares out of distributable profits.

capital structure

Relative proportions of equity capital and debt capital within an entity's balance sheet.

capital surplus

Assets remaining in an entity after all costs and liabilities have been discharged. It is distributed amongst the shareholders in accordance with the rights as determined at the time of the issue of shares.

capitalisation

Recognising a cost as part of the cost of an asset (IAS 23). The asset will be included in the balance sheet as a non-current asset.

carrying amount

Amount at which an asset is recognised in the balance sheet after deducting any accumulated depreciation (or amortisation) and accumulated impairment losses thereon (IAS 36).

cash

Cash on hand and demand deposits (IAS 7).

cash cow

Product characterised by a high market share but low market growth, whose function is seen as generating cash for use elsewhere within the entity.

cash equivalents

Short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to insignificant risk of changes in value (IAS 7).

cash flow statement

Summarises the inflows and outflows of cash (and cash equivalents) for a period, classified under the following headings: operating activities, investing activities and financing activities (refer to IAS 7).

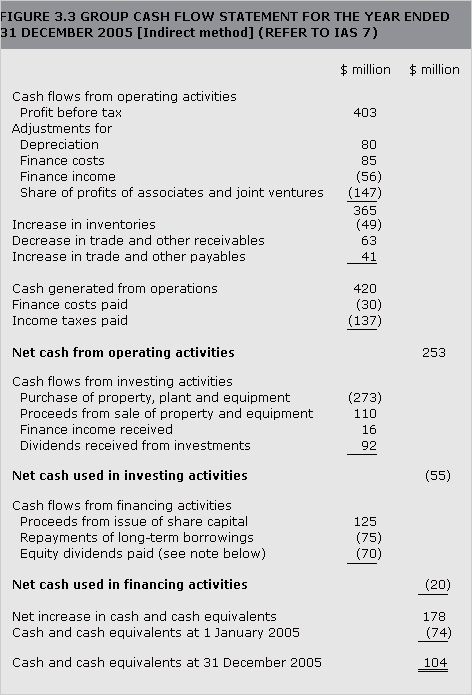

See Figure 3.3.

cash generating unit

Smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets (IAS 36).

cash management models

Sophisticated cash flow forecasting models which assist management in determining how to balance the cash needs of an entity. Cash management models can help: to optimise cash balances; to manage customer, supplier, investor and company needs; to determine whether to invest or buy back shares; and to decide what is the optimum of financing working capital.

centre

Department, area or function to which costs and/or revenues are charged.

See Figure 1.1.

budget centre: Centre for which an individual budget is drawn up.

cost centre: Production or service location, function, activity or item of equipment for which costs are accumulated.

See Figure 1.1.

investment centre: Profit centre with additional responsibilities for capital investment and possibly for financing, and whose performance is measured by its return on investment.

profit centre: Part of a business accountable for both costs and revenues.

responsibility centre: Departmental or organisational function whose performance is the direct responsibility of a specific manager.

revenue centre: Centre devoted to raising revenue with no responsibility for costs, for example a sales centre. Often used in not-for-profit organisations.

service cost centre: Cost centre providing services to other cost centres. When the output of an organisation is a service, rather than goods, an alternative name is normally used, for example support cost centre or utility cost centre.

See Figure 1.1

certainty equivalent method

Approach to dealing with risk in a capital budgeting context. It involves expressing risky future cash flows in terms of the certain cash flow which would be considered, by the decision maker, as their equivalent, that is the decision maker would be indifferent between the risky amount and the (lower) riskless amount considered to be its equivalent.

certificate of deposit

Negotiable instrument which provides evidence of a fixed-term deposit with a bank. Maturity is normally within 90 days, but can be longer.

CHAPS

Clearing House Automated Payment System. UK method for the rapid electronic transfer of funds between participating banks on behalf of large commercial customers, where transfers tend to be of significant value.

chartered entity

Organisation formed by the grant of a Royal Charter (in the UK). The charter authorises the entity to operate and states the powers specifically granted.

chart of accounts

Comprehensive and systematically arranged list of the named and numbered accounts applicable to an entity.

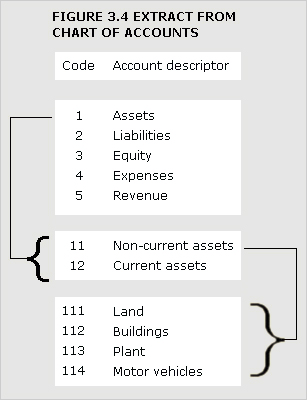

See Figure 3.4.

classification

Arrangement of items in logical groups by nature, purpose or responsibility. Classification systems allow financial information to be reported under subjective headings, by cost object or responsibility centre.

See code.

closing rate

Spot exchange rate (a rate for immediate delivery) at the balance sheet date (IAS 21).

code

Brief, accurate reference designed to assist classification of items by facilitating entry, collation and analysis. For example, in costing, the first three digits in the composite symbol 211.392 might indicate the nature of the expenditure (subjective classification), and the last three digits might indicate the cost centre or cost unit to be charged (objective classification).

code of ethics

Set of standards governing the conduct of members of a certain profession, by specifying expected standards for competence, professional behaviour and integrity. All members of the International Federation Accountants (IFAC) are expected to model their ethical codes on the IFAC code. There is therefore a specific ethical code for CIMA members.

collateral

Security, in the form of a claim over assets, generally given for borrowed funds over the period of a loan.

commercial paper

Unsecured short-term loan notes issued by companies, and generally maturing within a period of up to one year.

commitment accounting

Method of accounting which recognises expenditure as soon as it is contracted.

committee, audit

Formally constituted committee of an entity's main board of directors whose responsibilities include: monitoring the integrity of any formal announcements on financial performance including financial statements; reviewing internal financial controls, internal control and risk management systems; monitoring the effectiveness of the internal audit function; making recommendations in respect of the appointment or removal of the external auditor; reviewing and monitoring auditor independence and the effectiveness of the audit process.

committee, nominations

Formally constituted committee of an entity's main board of directors. The committee's main functions are to establish the criteria for board membership, identify suitable candidates and make recommendations for appointment to the board.

committee, remuneration

Formally constituted committee of an entity's main board of directors whose primary function is to consider the performance and remuneration of the executive directors. Remuneration issues will include performance-related payments, pension rights, compensation payments and share option schemes.

commodity pricing

Pricing a product or service on the basis that it is undifferentiated from all competitive offerings, and cannot therefore command any price premium above the base market price.

company limited by guarantee

Company in which each member undertakes to contribute (to the limit of the guarantee), on a winding up, towards payment of the liabilities of the company.

company limited by shares/joint stock company/limited liability company

Company in which the liability of members for the company's debts is limited to the value of the shares taken up by them.

See private company and public company.

company/corporation

Legal entity, whose life is independent of that of its members. In the UK, companies or corporations are predominantly formed through registration under the UK Companies Act 1985.

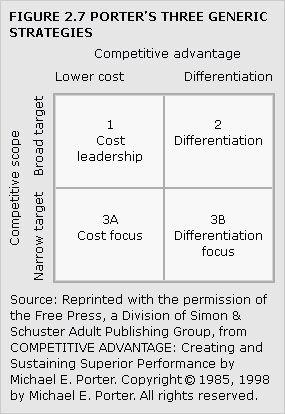

competitive advantage

Situation where an organisation exerts more competitive force on its competitors than they exert on it.

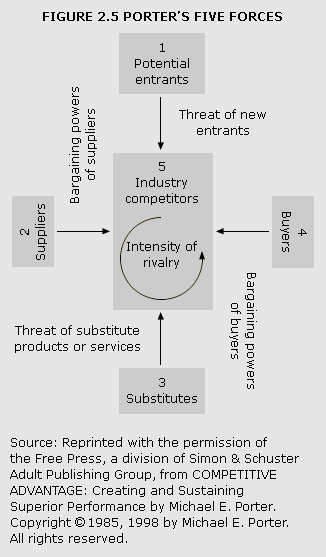

See Porter's five forces

competitive forces

See Porter's five forces

competitor analysis

Identification and quantification of the relative strengths and weaknesses (compared with competitors or potential competitors), which could be of significance in the development of a successful competitive strategy.

component of an entity

Operations and cash flows that can be clearly distinguished operationally, and for financial reporting purposes, from the rest of the entity (IFRS 5).

compound instrument

Financial instrument that, from the issuer's perspective, contains both a liability and an equity element (IAS 32).

compound interest

Interest which is calculated over successive periods based on the principal plus accrued interest.

See simple interest.

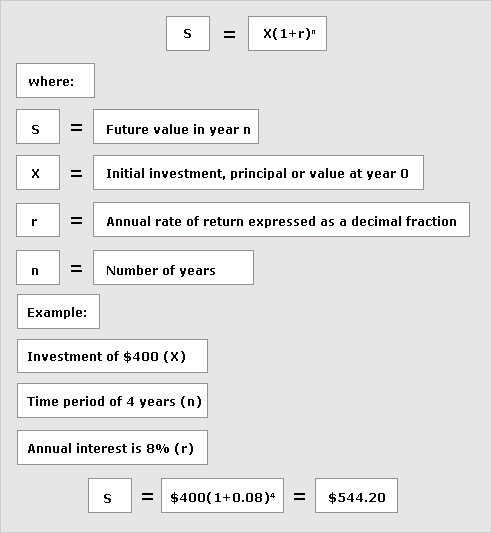

The future value of an investment, over whose period interest is compounded, can be found by using the following formula:

conglomerate

Entity comprising a number of dissimilar businesses.

consignment inventory

Inventory held by one party (the dealer) but legally owned by another (the manufacturer) on terms that may give the dealer the right to sell the inventory in the normal course of business or, at the dealer's option, return it unsold to the manufacturer.

consol

Certain irredeemable UK government stocks carrying fixed coupons. Sometimes used as a general term for an undated or irredeemable bond.

consolidated financial statements

Financial statements of a group presented as those of a single economic entity (IAS 27).

consortium

Association of several entities with a view to carrying out a joint venture.

See joint venture

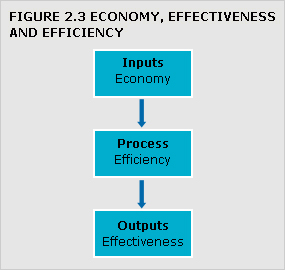

constraint

Activity, resource or policy that limits the ability to achieve an objective.

See theory of constraints.

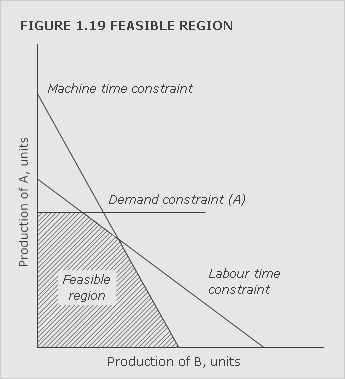

In linear programming, constraints define the feasible region within which a solution must lie.

See linear programming.

See Figure 1.19.

construction contract

Specifically negotiated for the construction of an asset or a combination of assets that are closely inter-related or inter-dependent in terms of their design, technology and function or their ultimate purpose or use (IAS 11).

constructive obligation

Obligation that derives from an entity's actions where: (a) by an established pattern of past practice, published policies or a sufficiently specific current statement, the entity has indicated to other parties that it will accept certain responsibilities; and (b) as a result, the entity has created a valid expectation on the part of those other parties that it will discharge those responsibilities (IAS 37).

Consultative Committee of Accountancy Bodies (CCAB)

A forum (now a limited company) in which matters affecting the six member bodies and the UK and Irish professions as a whole can be discussed and co-ordinated, thus allowing the profession to speak with a unified voice to the UK and Irish governments. The six member bodies are ACCA, CIMA, CIPFA, ICAEW, ICAI and ICAS.

contingency plan

A plan, formulated in advance, to be implemented upon the occurrence of certain specific future events.

contingent asset

Possible asset that arises from past events and whose existence will be confirmed only by the occurrence of one or more uncertain future events not wholly within the control of the entity (IAS 37).

contingent liability

(a) A possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the entity's control; or (b) A present obligation that arises from past events but is not recognised because it is not probable that a transfer of economic benefits will be required to settle the obligation; or the amount of the obligation cannot be measured with sufficient reliability (IAS 37).

continuing operation

See discontinued operation.

continuous improvement

Derived from the Japanese term kaizen. A simple idea but when taken seriously over a period can lead to significant improvements.

See kaizen.

contribution

(sales value – variable cost of sales)

Contribution may be expressed as total contribution, contribution per unit or as a percentage of sales.

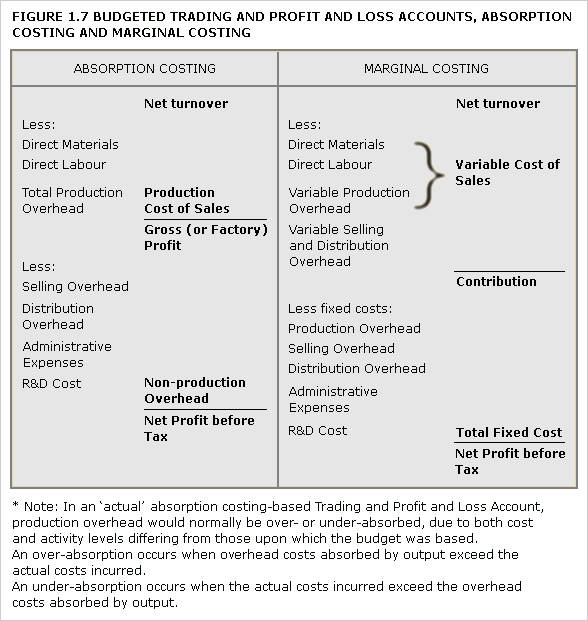

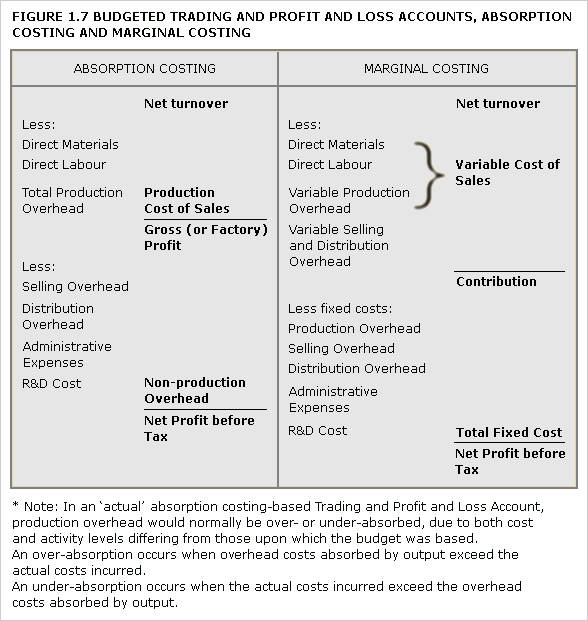

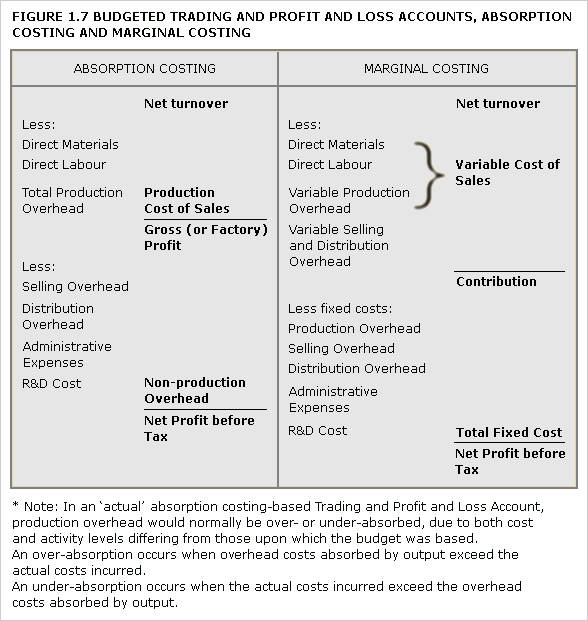

See Figure 1.7.

control

In management accounting, control usually means ensuring that activities planned and undertaken lead to desired outcomes.

See control, feedback and control, feedforward.

control (in the context of an asset)

Ability to obtain the future economic benefits relating to an asset and to restrict the access of others to these benefits.

control (of an entity)

Power to govern the financial and operating policies of an entity so as to obtain benefits from its activities (IAS 27).

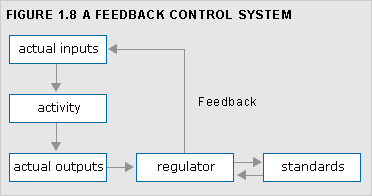

control, feedback

Measurement of differences between planned outputs and actual outputs achieved, and the modification of subsequent action and/or plans to achieve future required results. Feedback control is an integral part of budgetary control and standard costing systems.

See Figure 1.8.

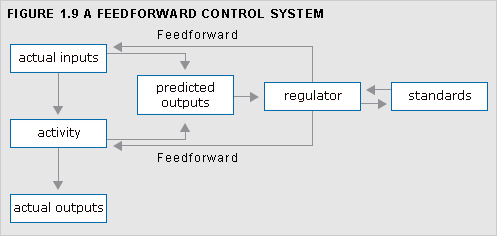

control, feedforward

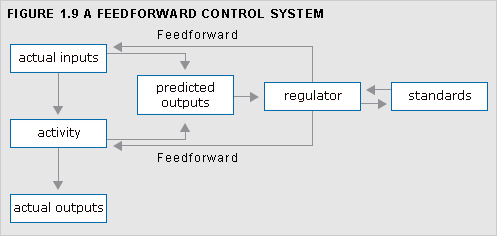

Forecasting of differences between actual and planned outcomes, and the implementation of action, before the event, to avoid such differences.

See Figure 1.9.

control, management

All of the processes used by managers to ensure that organisational goals are achieved and procedures adhered to, and that the organisation responds appropriately to changes in its environment.

closed loop system: Control system that includes provision for corrective action, taken on either a feedforward or a feedback basis.

See Figures 1.8 and 1.9.

open loop system : Control system that includes no provision for corrective action to be applied to the sequence of activities.

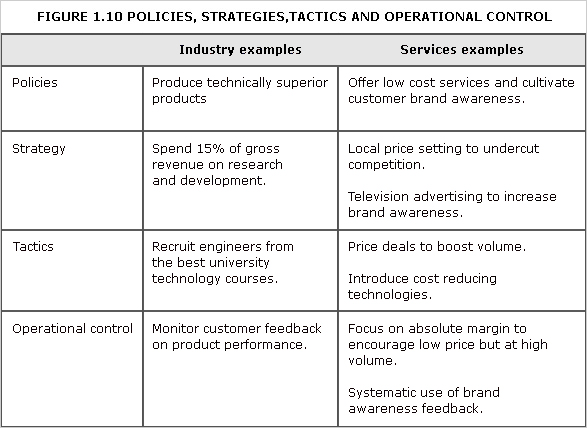

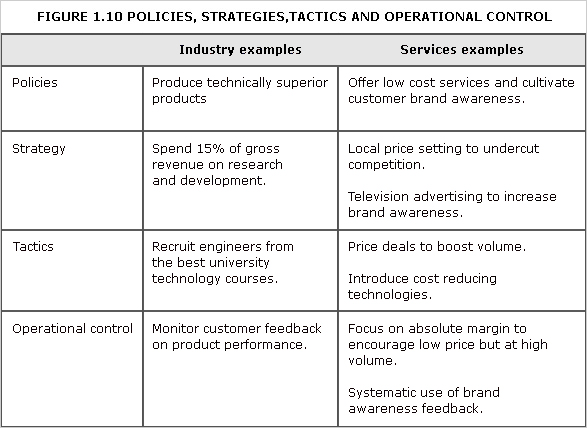

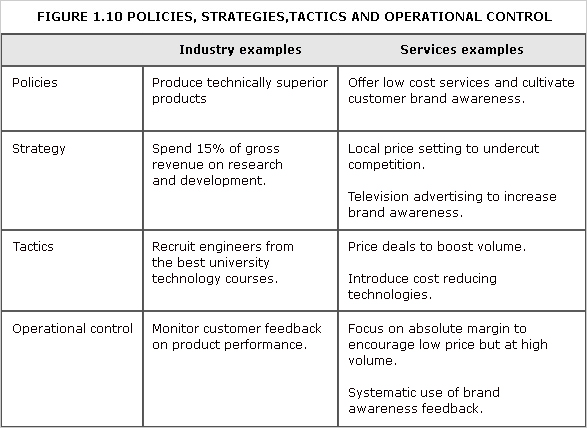

control, operational

Management of daily activities in accordance with strategic and tactical plans.

See Figure 1.10

convertible debt

Liability that gives the holder the right to convert into another instrument, normally ordinary shares at a predetermined price/rate and time.

corporate appraisal

Critical assessment of the strengths and weaknesses, opportunities and threats (SWOT analysis) in relation to the internal and environmental factors affecting an entity in order to establish its condition prior to the preparation of the long-term plan.

corporate social accounting

Reporting of the social and environmental impact of an entity's activities upon those who are directly associated with the entity (for instance, employees, customers, suppliers) or those who are in any way affected by the activities of the entity, as well as an assessment of the cost of compliance with relevant regulations in this area.

corporation tax

Tax chargeable on companies resident in the UK or trading in the UK. Referred to internationally as income tax.

cost

As a noun: the amount of cash or cash equivalent paid or the fair value of other consideration given to acquire an asset at the time of its acquisition or construction (IAS 16). As a verb: to ascertain the cost of a specified thing or activity. The word cost can rarely stand alone and should be qualified as to its nature and limitations.

cost account

Record of expenditure associated with a cost object such as a job, batch, contract or process. Revenue may be credited to the account as, for example, when a process by-product has value.

cost accounting

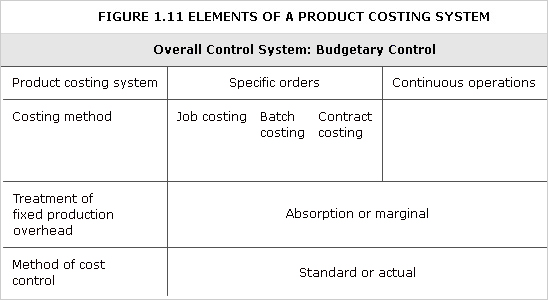

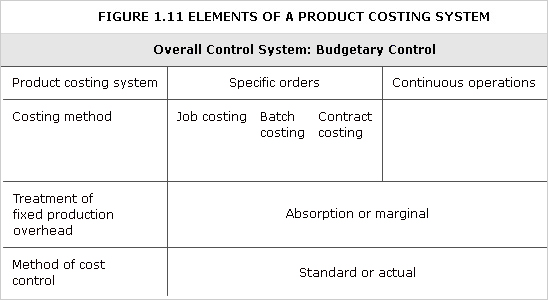

Gathering of cost information and its attachment to cost objects, the establishment of budgets, standard costs and actual costs of operations, processes, activities or products; and the analysis of variances, profitability or the social use of funds. The use of the term costing is not recommended except with a qualifying adjective, for example: standard costing, batch costing, continuous operation costing, contract costing, job costing, service/fn costing, specific order costing and marginal costing.

cost accounting—for cost objects

batch costing: Form of specific order costing where costs are attributed to batches of product (unit costs can be calculated by dividing by the number of products in the batch).

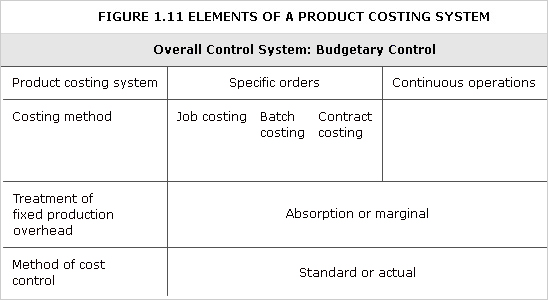

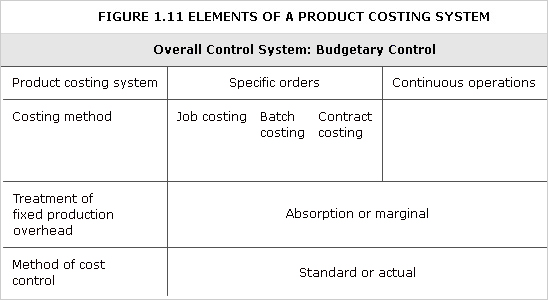

See figure 1.11

contract costing: Form of specific order costing where costs are attributed to contracts.

See Figure 1.11.

job costing: Form of specific order costing where costs are attributed to individual jobs.

See Figure 1.11.

operations costing: Form of costing where costs are attributed to individual operations within a manufacturing process.

process costing: Form of costing applicable to continuous processes where process costs are attributed to the number of units produced. This may involve estimating the number of equivalent units in stock at the start and end of the period under consideration.

See Figure 1.11.

specific order costing: Basic cost accounting method applicable if work consists of separately identifiable batches, contracts or jobs.

See Figure 1.11.

cost accounting—methods

absorption costing: Assigns direct costs and all or part of overhead to cost units using one or more overhead absorption rates.

See Figure 1.1.

Sometimes referred to as full costing although this is a misnomer if all costs are not attributed to cost units.

direct costing: See variable costing.

full costing: See absorption costing.

marginal costing: See variable costing.

uniform costing: Used by several undertakings, usually in the same industry, of the same costing methods, principles and techniques.

variable costing: Assigns only variable costs to cost units while fixed costs are written off as period costs.

See Figure 1.7.

Also known as marginal costing and, especially in the US, as direct costing.

cost allocation/apportionment

See allocation and apportionment.

cost, avoidable

Specific cost of an activity or sector of a business that would be avoided if the activity or sector did not exist.

cost behaviour

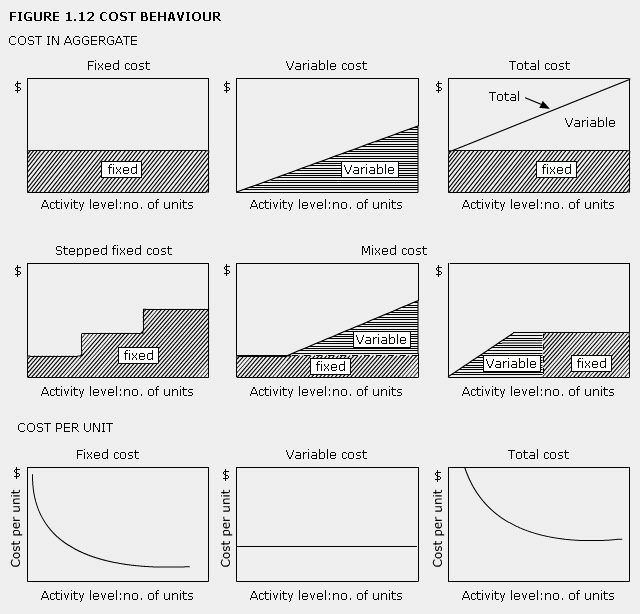

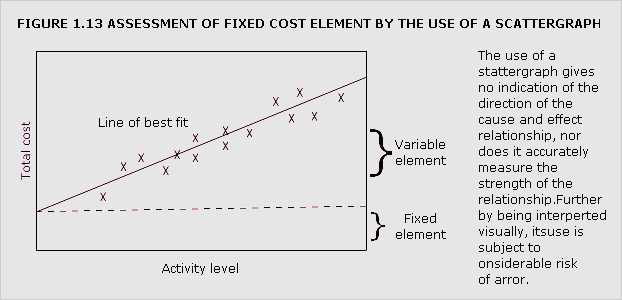

Variability of input costs with activity undertaken. Cost may increase proportionately with increasing activity (the usual assumption for a variable cost), or it may not change with increased activity (a fixed cost). Some costs (semi-variable) may have both variable and fixed elements. Other behaviour is possible, costs may increase more or less than in direct proportion, and there may be step changes in cost, for example. To a large extent cost behaviour will be dependent on the timescale assumed.

See Figures 1.12 and 1.13.

cost-benefit analysis

Comparison between the costs of the resources used plus any other costs imposed by an activity (for example pollution, environmental damage) and the value of the financial and non-financial benefits derived.

cost classification

Arrangement of elements of cost into logical groups with respect to their nature (fixed, variable, value adding), function (production, selling) or use in the business of the entity.

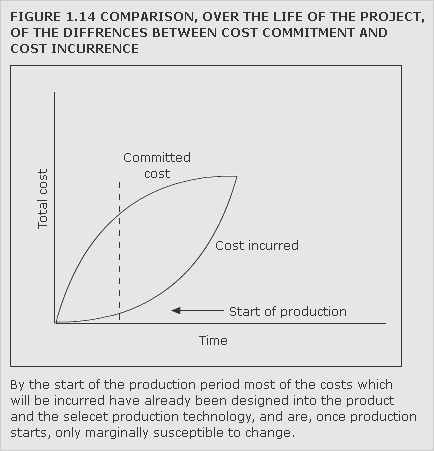

cost, committed

Cost arising from prior decisions, which cannot, in the short run, be changed. Committed cost incurrence often stems from strategic decisions concerning capacity with resulting expenditure on plant and facilities. Initial control of committed costs at the decision point is through investment appraisal techniques.

See commitment accounting.

See Figure 1.14.

cost, common

Cost relating to more than one product or service.

cost, contract

Aggregated costs of a single contract. This usually applies to major long-term contracts rather than short-term jobs.

cost control

Process that ensures action is taken if costs exceed a pre-set allowance (See control, feedback) or that action is taken if costs are forecast to exceed expected levels.

See control, feedforward.

cost, controllable

Cost that can be controlled, typically by a cost, profit or investment centre manager.

cost, conversion

Cost of converting material into finished product, typically including direct labour, direct expense and production overhead.

cost, differential/incremental

Difference in total cost between alternatives. This is calculated to assist decision making.

cost, direct

Expenditure that can be attributed to a specific cost unit, for example material that forms part of the product.

See Figure 1.1.

cost, discretionary

Cost whose amount within a time period is determined by a decision taken by the appropriate budget holder. Marketing, research and training are generally regarded as discretionary costs. Also known as managed or policy costs.

cost driver

Factor influencing the level of cost. Often used in the context of ABC to denote the factor which links activity resource consumption to product outputs, for example the number of purchase orders would be a cost driver for procurement cost.

cost elements

Constituent parts of costs according to the factors upon which expenditure is incurred, namely material, labour and expenses.

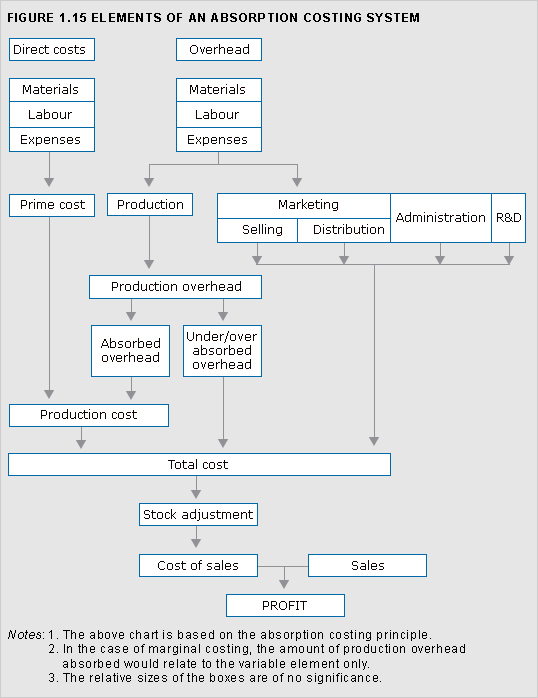

See Figure 1.15.

cost estimation

Determination of cost behaviour. This can be achieved by engineering methods, analysis of the accounts, use of statistics or by the pooling of expert views.

cost, fixed

Cost incurred for an accounting period, that, within certain output or turnover limits, tends to be unaffected by fluctuations in the levels of activity (output or turnover).

cost, holding

Cost of retaining an asset, generally stock. Holding cost includes the cost of financing the asset in addition to the cost of physical storage.

cost, joint

Cost of a process which results in more than one main product.

cost, long-term variable

All costs are variable in the long run. Full unit costs may be surrogates for long-term variable costs if calculated in a manner which utilises long-term cost drivers, for example activity-based costing.

cost management

Application of management accounting concepts, methods of data collection, analysis and presentation in order to provide the information needed to plan, monitor and control costs.

cost, marginal

Part of the cost of one unit of product or service that would be avoided if the unit were not produced, or that would increase if one extra unit were produced.

cost, notional

Cost used in product evaluation, decision making and performance measurement to reflect the use of resources that have no actual (observable) cost. For example, notional interest for internally generated funds or notional rent for use of space.

cost object

For example a product, service, centre, activity, customer or distribution channel in relation to which costs are ascertained.

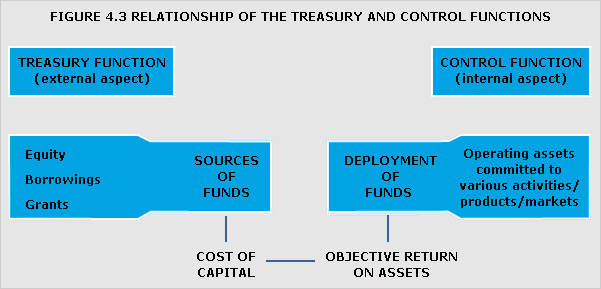

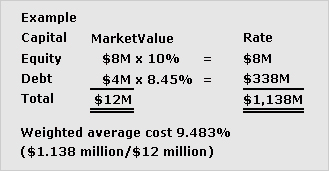

cost of capital

Minimum acceptable return on an investment, generally computed as a discount rate for use in investment appraisal exercises. The computation of the optimal cost of capital can be complex, and many ways of determining this opportunity cost have been suggested.

See weighted average cost of capital

cost of quality

Difference between the actual cost of producing, selling and supporting products or services and the equivalent costs if there were no failures during production or usage. The cost of quality can be analysed into:

cost of conformance: Cost of achieving specified quality standards.

cost of prevention: Costs incurred prior to or during production in order to prevent substandard or defective products or services from being produced.

cost of appraisal: Costs incurred in order to ensure that outputs produced meet required quality standards.

cost of non-conformance: Cost of failure to deliver the required standard of quality.

cost of internal failure: Costs arising from inadequate quality which are identified before the transfer of ownership from supplier to purchaser.

cost of external failure: Cost arising from inadequate quality discovered after the transfer of ownership from supplier to purchaser.

Note: There is no universally accepted definition of quality, which may be assessed on a number of bases, such as conformance to specification, ability to satisfy wants, inclusion of attractive performance/aesthetic attributes, or offering value for money.

cost of sales

The cost of goods sold during an accounting period. For a retail business this will be the cost of goods available for sale (opening stock plus purchases) minus closing stock. For a manufacturing business it will include all direct and indirect production costs.

cost, opportunity

The value of the benefit sacrificed when one course of action is chosen in preference to an alternative. The opportunity cost is represented by the foregone potential benefit from the best rejected course of action.

cost, overhead/indirect

Expenditure on labour, materials or services that cannot be economically identified with a specific saleable cost unit. The synonymous term burden is in common use in the US and in subsidiaries of American companies.

cost, period

Cost relating to a time period rather than to the output of products or services.

cost pool

Grouping of costs relating to a particular activity in an activity-based costing system.

cost, post-purchase

Cost incurred after a capital expenditure decision has been implemented and facilities acquired. May include training, maintenance and the cost of upgrades.

cost, prime

Total cost of direct material, direct labour and direct expenses.

cost, product

Cost of a finished product built up from its cost elements.

cost, production

Prime cost plus absorbed production overhead.

cost, replacement

Cost of replacing an asset. This is important in relevant costing because if, for example, material that is in constant use is needed for a product or service, the relevant cost of that material will be its replacement cost. Replacement cost has also been proposed as an alternate to historic cost accounting and it can, therefore, be an important concept with relevance to accounting for inflation or measuring performance where the value of assets is important.

cost, semi-variable

Cost containing both fixed and variable components and thus partly affected by a change in the level of activity.

cost, standard

Planned unit cost of a product, component or service. The standard cost may be determined on a number of bases (see standard). The main uses of standard costs are in performance measurement, control, stock valuation and in the establishment of selling prices.

See standard product specification.

cost, sunk

Cost that has been irreversibly incurred or committed and cannot therefore be considered relevant to a decision. Sunk costs may also be termed irrecoverable costs.

cost table

Database containing costs associated with production of a product, broken down by function and/or components and sub-assemblies. It incorporates cost changes that would result from possible changes in the input mix.

cost, target

Product cost estimate derived by subtracting a desired profit margin from a competitive market price.

cost unit

Unit of product or service in relation to which costs are ascertained.

See Figure 1.16.

cost, variable

Cost that varies with a measure of activity.

cost-volume-profit analysis (CVP)

Study of the effects on future profit of changes in fixed cost, variable cost, sales price, quantity and mix.

cost, weighted average

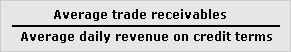

Method of unit cost determination, often applied to stocks, in which an average unit cost is calculated, when a new purchase quantity is received: ![]()

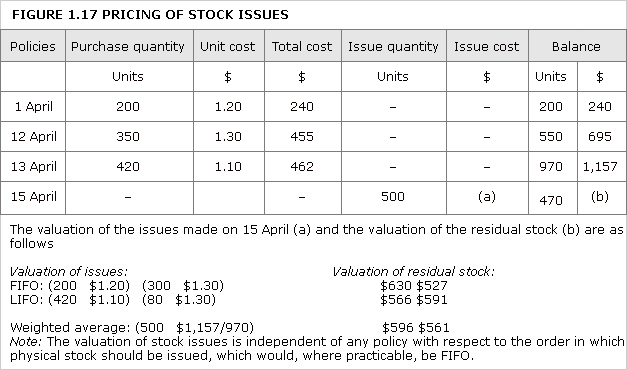

See Figure 1.17.

costing, backflush

Method of costing, associated with a JIT (just-in-time) production system, which applies cost to the output of a process. Costs do not mirror the flow of products through the production process, but are attached to output produced (finished goods stock and cost of sales), on the assumption that such backflushed costs are a realistic measure of the actual costs incurred.

See just-in-time.

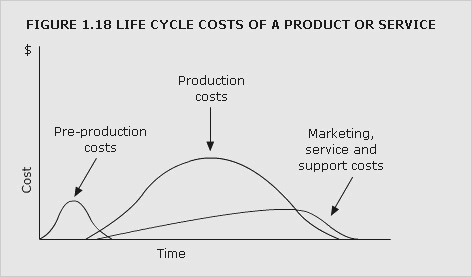

costing, life-cycle

Maintenance of physical asset cost records over entire asset lives, so that decisions concerning the acquisition use or disposal of assets can be made in a way that achieves the optimum asset usage at the lowest possible cost to the entity. The term may be applied to the profiling of cost over a product's life, including the pre-production stage (terotechnology), and to both company and industry life cycles

See Figure 1.18.

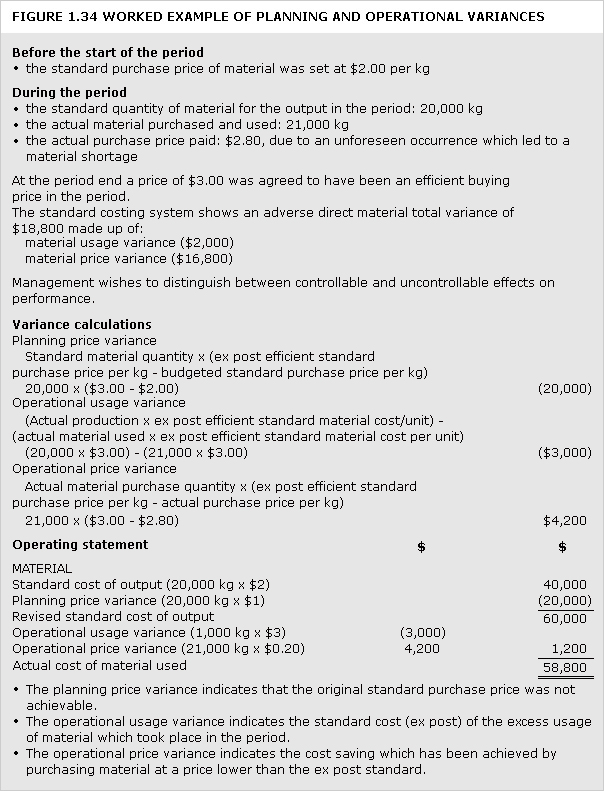

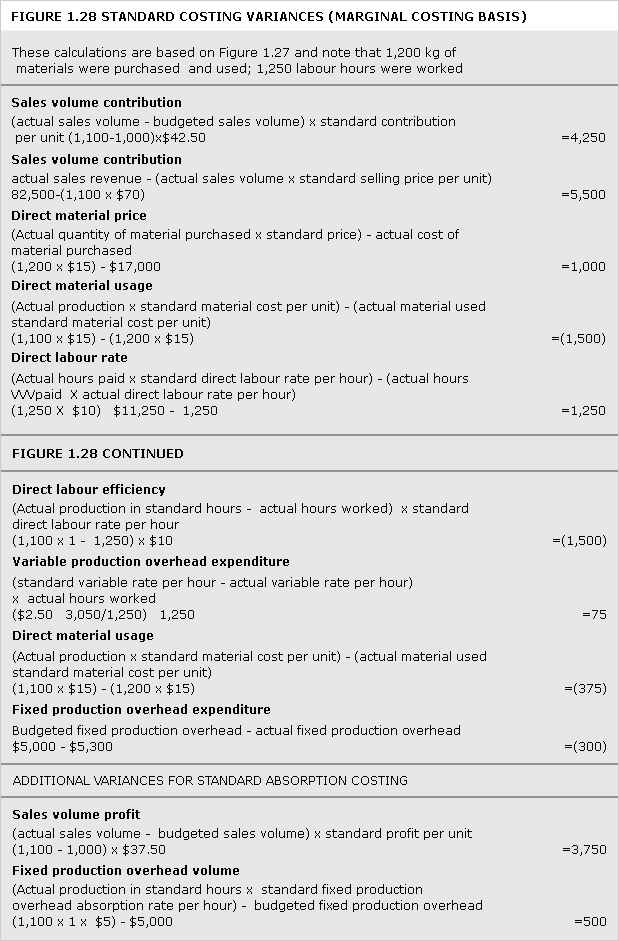

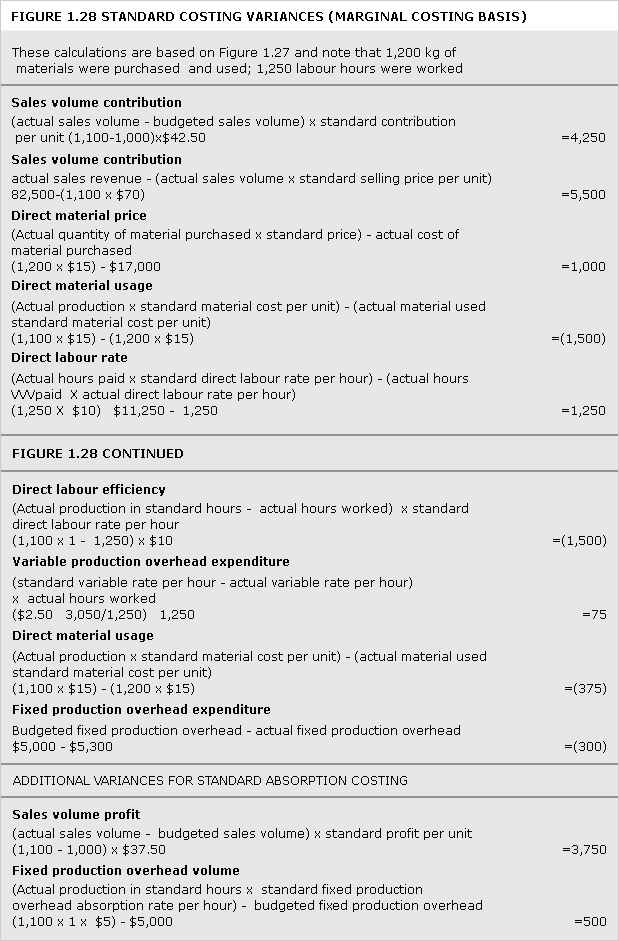

costing, standard

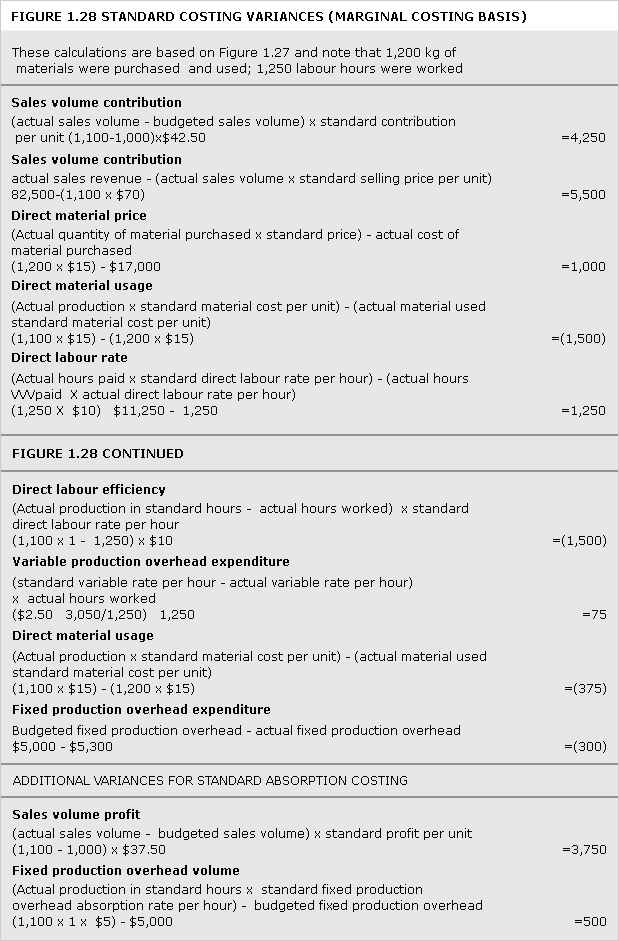

Control technique that reports variances by comparing actual costs to pre-set standards so facilitating action through management by exception.

countertrade

Form of trading activity based on other than an arm's-length goods for cash exchange. Types of countertrade include:

barter: Direct exchange of goods and services between two parties without the use of money.

counterpurchase: Trading agreement in which the primary contract vendor agrees to make purchases of an agreed percentage of the primary contract value, from the primary contract purchaser, through a linked counterpurchase contract.

Offsets: Trading agreement in which the purchaser becomes involved in the production process, often acquiring technology supplied by the vendor.

coupon

Interest payable on a bond expressed as a percentage of the nominal value.

creative accounting

Form of accounting which, while complying with all regulations and practices, nevertheless gives a biased impression (generally favourable) of an entity's financial performance and position.

See window-dressing.

creditor

See payables.

credit scoring

Assessment of the creditworthiness of an individual or company by rating numerically a number of both financial and non-financial aspects of the target's present position and previous performance.

critical success factor

An element of organisational activity which is central to its future success. Critical success factors may change over time, and may include items such as product quality, employee attitudes, manufacturing flexibility and brand awareness.

cum

'With', as in cum dividend, where security purchases include rights to the next dividend payment, and cum rights, where shares are traded with rights, such as to a scrip issue, attached.

current account

Record of transactions between two parties. For example, between a bank and its customer or a branch and its head office.

current asset

Asset which satisfies any of the following criteria: (a) is expected to be realised in, or is intended for sale or consumption in, the entity's normal operating cycle; (b) is held primarily for the purpose of being traded; (c) is expected to be realised within twelve months of the balance sheet date; or (d) is cash or cash equivalent (IAS 1).

current cost accounting (CCA)

Method of accounting in which profit is defined as the surplus after allowing for price changes on the funds needed to continue the existing business and to maintain its operating capability, whether financed by shares or borrowing. A CCA balance sheet shows the effect of physical capital maintenance.

current liability

Liability which satisfies any of the following criteria: (a) is expected to be settled in the entity's normal operating cycle; (b) is held primarily for the purpose of being traded; or (c) is due to be settled within twelve months of the balance sheet date. All other liabilities are classified as non-current (IAS 1).

current purchasing power accounting (CPP)

Method of accounting in which the values of non-monetary items in the historical cost financial statements are adjusted, using a general price index, so that the resulting profit allows for the maintenance of the purchasing power of the shareholders' interest in the entity. A CPP balance sheet shows the effect of financial capital maintenance.

current tax

Amount of income taxes payable (or recoverable) in respect of the taxable profit (or loss) for a period (IAS 12).

customer account profitability

Analysis of the revenue streams and service costs associated with specific customers or customer groups.

Method of analysing the profits of an organisation by attributing costs and revenues to customers, rather than to products (as in direct product profitability).

customer profitability analysis (CPA)

Analysis of the revenue streams and service costs associated with specific customers or customer groups.

customer relationship management (CRM)

A culture, possibly supported by appropriate information systems, where emphasis is placed on the interfaces between the entity and its customers. Knowledge is shared, within the entity, to ensure that the customer receives a consistently high service level.

date of transition (to IFRSs)

Beginning of the earliest period for which an entity presents full comparative information under IFRSs in its first IFRS-compliant financial statements (IFRS 1).

debt capacity

Extent to which an entity can support and/or obtain loan finance.

debtor

See receivables.

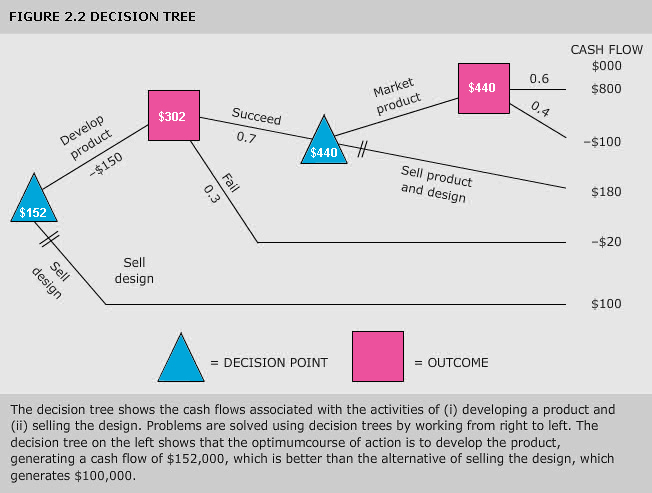

decision tree

Pictorial method of showing a sequence of interrelated decisions and their expected outcomes. Decision trees can incorporate both the probabilities of, and values of, expected outcomes, and are used in decision making.

See Figure 2.2.

deductible temporary difference

Temporary difference that will result in amounts that are deductible in determining taxable profit (or tax loss) of future periods when the carrying amount of the asset or liability is recovered or settled (IAS 12).

deep discount bond

Bond offered at a large discount on the face value of the debt so that a significant proportion of the return to the investor comes by way of a capital gain on redemption, rather than through interest payments.

deferred expenditure

Expenditure not charged against income in an accounting period but carried forward as a non-current or current asset to be charged in one or more subsequent periods, for example development expenditure (refer to IAS 38).

deferred tax

Difference between the tax ultimately payable on the profits recognised in an accounting period and the actual amount of tax payable for the same accounting period. The former figure will be based on the tax implications of accounting profit and the carrying amounts of assets and liabilities. The latter figure will be based on a calculation of profits as recognised by the tax authorities.

deferred tax asset

Amount of income taxes recoverable in future periods in respect of deductible temporary differences, carried forward unused tax losses and unused tax credits (IAS 12).

deferred tax liability

Amount of income taxes payable in future periods in respect of taxable temporary differences (IAS 12).

defined benefit plan

Any post-employment scheme other than a defined contribution plan (IAS 19). In such a scheme the employer takes the risk—also known as a final salary scheme.

defined contribution plan

Post-employment benefit plan under which an entity pays fixed contributions into a separate entity (the fund) and will have no legal or constructive obligation to pay further contributions, if the fund does not hold sufficient assets to pay all employee benefits relating to their service in the current and prior periods (IAS 19). In such a scheme the employee takes the risk—also known as a money purchase scheme.

depreciable amount

Cost of an asset, or other amount substituted for cost, less the residual value (IAS 16).

depreciation

Systematic allocation of the depreciable amount of an asset over its useful life (IAS 16). Normally applied to tangible assets.

See amortisation.

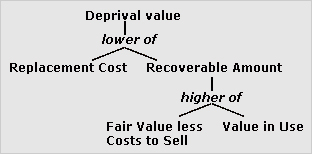

deprival value

Basis for valuing assets based on the maximum amount which an entity would be willing to pay rather than forgo the asset. Deprival value is the lower of replacement cost and recoverable amount (itself the higher of fair value less costs to sell and value in use).

See impairment.

de-recognition

Removal of a previously recognised asset (or liability) from an entity's balance sheet.

development costs

Costs incurred in applying research findings or other knowledge to a plan or design for the production of new or substantially improved materials, devices, products, processes, systems or services prior to the commencement of commercial production or use (IAS 38).

dilution

Reduction in the earnings and voting power per share caused by an increase or potential increase in the number of shares in issue. For the purpose of calculating diluted earnings per share, the profit attributable to ordinary shareholders and the weighted average number of shares outstanding should be adjusted for the effects of all dilutive potential ordinary shares.

Also See anti-dilution.

direct product profitability (DPP)

Used primarily within the retail sector, DPP involves the attribution of both the purchase price and other indirect costs (for example distribution, warehousing and retailing) to each product line. Thus a net profit, as opposed to a gross profit, can be identified for each product. The cost attribution process utilises a variety of measures (for example warehousing space and transport time) to reflect the resource consumption of individual products.

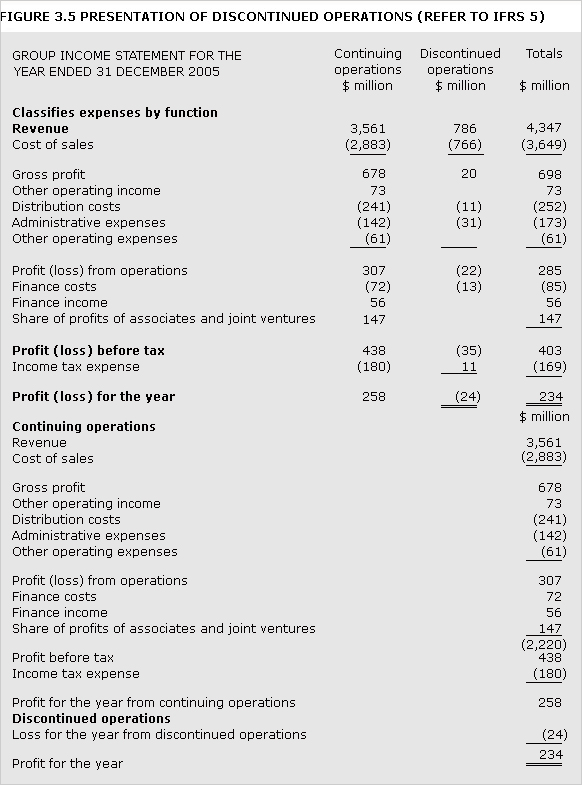

discontinued operation

Component of an entity that has either been disposed of or is classified as held for sale and: (a) represents, or is part of a single plan to dispose of, a separate major line of business or geographical area of operations; or (b) is a subsidiary acquired exclusively with a view to resale (IFRS 5).

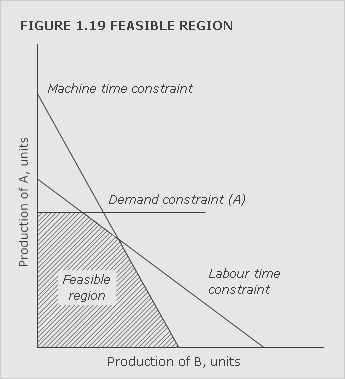

See Figure 3.5.

discount rate (capital investment appraisal)

Percentage rate used to discount future cash flows generated by a capital project.

discounted cash flow (DCF)

Discounting of the projected net cash flows of a capital project to ascertain its return or present value. The methods commonly used are:

discounted payback: The discount rate is used to calculate the present values of periodic cash flows with a payback period then being calculated.

net present value (NPV): The discount rate is chosen and the present value is expressed as a sum of money.

yield, or internal rate of return (IRR): The calculation determines the return in the form of a percentage.

See capital investment appraisal, net present value, internal rate of return and discounted payback.

discounted payback

Capital investment method with the aim of determining the period of time required to recover initial cash outflow when net cash inflows are discounted at the opportunity cost of capital.

Also see payback and discounted cash flow.

disposal group

Group of assets to be disposed of, by sale or otherwise, together as a group in a single transaction, and liabilities directly associated with those assets that will be transferred in the transaction (IFRS 5).

distributable reserves

Profit for a period, plus retained earnings from previous periods, that are available for payment as dividends (or other distributions to owners). The split between distributable and non-distributable reserves is a UK legal requirement to ensure that creditors have some protection from the effects of losses.

distribution costs

Cost of warehousing saleable products and delivering them to customers. These costs are reported in the income statement.

divestment

Disposal of part of its activities by an entity.

dividend

Distribution of profits to the holders of equity investments in proportion to their holdings of a particular class of capital (IAS 18).

dividend growth model

Way of assessing the value of shares by capitalising future dividends that grow at a constant rate.

dividend yield

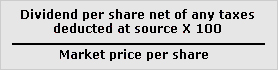

Post-tax dividend return on market value offered by the shares shown as a percentage.

documentary credit

Arrangement, used in the finance of international transactions, whereby a bank undertakes to make a payment to a third party on behalf of a customer.

dominant influence

Influence that can be exercised over an entity to achieve the operating and financial policies designed by the holder of the influence, notwithstanding the rights or influence of any other party.

double-entry bookkeeping/accounting

Most commonly used system of bookkeeping based on the principle that every financial transaction involves the simultaneous receiving and giving of value, and is therefore recorded twice.

double taxation agreement

Agreement between two countries intended to avoid the double taxation of income which would otherwise be subject to taxation in both.

doubtful debts provision

Amount charged against profit and deducted from trade receivables to allow for the estimated non-recovery of a proportion of the trade receivables.

See bad debt.

downsizing

Organisational restructuring involving outsourcing activities, replacing permanent staff with contract employees and reducing the number of levels within the organisational hierarchy, with the intention of making the entity more flexible, efficient and responsive to its environment.

earnings per share, basic

Profit for the period that is attributable to ordinary shareholders (the numerator) divided by the weighted average number of ordinary shares outstanding during the period (the denominator) (IAS 33).

earnings per share, diluted

Basic earnings per share with both the numerator and the denominator adjusted for the effects of all dilutive potential ordinary shares (refer to IAS 33).

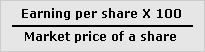

earnings yield

As a percentage, indicates the total amount earned in respect of each equity share in issue, in relation to the market price of the share. The earnings yield computation can also be based on the aggregate earnings and the market value of the equity capital.

earn-out arrangement

Procedure whereby owners/managers selling an entity receive a portion of their consideration linked to the financial performance of the business during a specified period after the sale. The arrangement gives a measure of security to the new owners, who pass some of the financial risk associated with the purchase of a new enterprise to the sellers.

economic exposure

Risk that a company's future cash flows will vary as a result of changes in exchange rates.

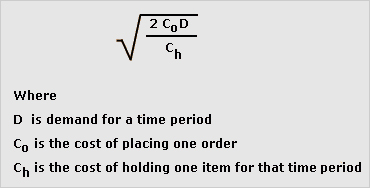

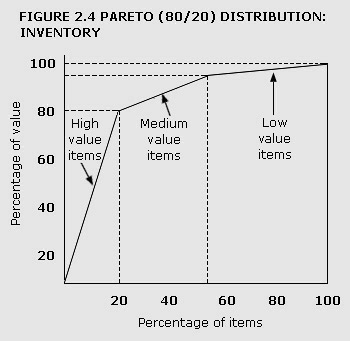

economic order quantity (EOQ)

Most economic stock replenishment order size, which minimises the sum of stock ordering costs and stockholding costs. EOQ is used in an 'optimising' stock control system. EOQ may be calculated as:

economic value added (EVA)

Profit less a charge for capital employed in the period. Accounting profit may be adjusted, for example, for the treatment of goodwill and research and development expenditure, before economic value added is calculated (Stern Stewart & Co).

economies of scale

Reductions in unit average costs caused by increasing the scale of production.